Data empowers Valencia CF to create personalized fan experiences

This article is contributed. See the original author and article here.

We all know one, the person whose weekend is consumed by a singular passion for their favorite sports team. Their weekdays are dedicated to deconstructing the recent drama while contemplating the narrative awaiting the Saturday or Sunday afternoon ahead. The rain-soaked terraces are home to them. The booming music of the arena is their hymn book, and the legendary names hanging from the rafters are their heroes. A peek into their closet will reveal a sea of matching colors printed on scarves and t-shirts. Their social media will be awash with images of heroes present and past, opinions of games told in terms worthy of epic conquests, and, of course, the barbed insult to anyone who dares question the validity of their narrative.

Read how Microsoft helped Valencia CF unlock the value of their customer data to create super fans.

Engage super fans through actionable insights

This is the world of the sports “super fan”they are the backbone of the world’s greatest sports franchises. Along with their passion, the super fan is the mainstay of a team’s economy, accounting for a disproportionate number of ticket sales, merchandise, media impressions, and revenue. Teams all over the world love their super fans. In some countries and sports, they have seats in the boardroom and strong voices in ownership decisions. And while it is tempting to view the super fan as a dynastic, generational phenomenon passed on through time and culture, the truth is that today, the super fan is a function of data as much as history. Big, multidimensional data gleaned from the numerous touch points between fans and sports franchises is woven into insights that are specific and actionable at an individual level. Data is how casual fans ascend the ladder of engagement to become super fans and how super fans are rewarded and celebrated.

Row 15 seat 164 in Valencia’s vast Mestalla Stadium is a hallowed place. It is occupied by a statue honoring Seor Vicente Navarro Aparicio, a lifelong Valencia CF fan who sat in that seat for 25 years, never missing a game, even when his eyesight failed him in his later years. Seor Aparicio is the very definition of “super fan.” Valencia CF is more than 100 years old with a proud history of Spanish and international success, and a worldwide fan base of more than 50 million supporters. Although fan engagement has always been a top priority, the club didn’t always know its fans or what they needed in the intimate detail they do today. When Franco Segarra joined Valencia CF as Innovation Director, he immediately recognized the need for a new game plan to enhance fan engagement.

“Super fans aren’t like ordinary customers. They are passionateexperiencing euphoria and shedding tears or losing sleep with the inevitable ups and downs. The sport is steeped in tradition, where fans have special rituals, passed down from parents and grandparents. Therefore, each fan is unique. Fragmented data makes it impossible to understand, let alone deliver, deeply personal experiences that speak to each fan as an individual.”Franco Segarra, Innovation Director, Valencia CF.

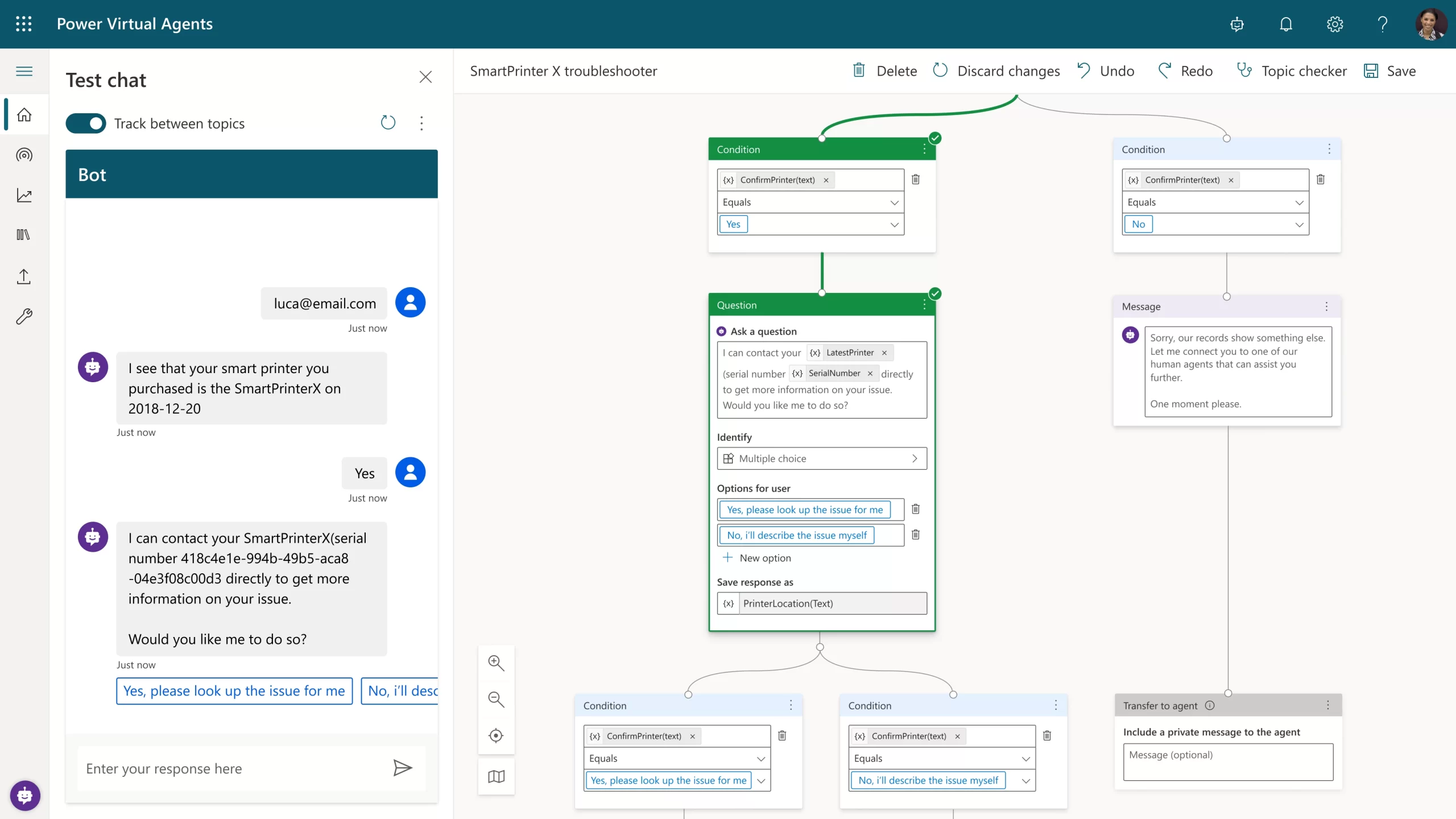

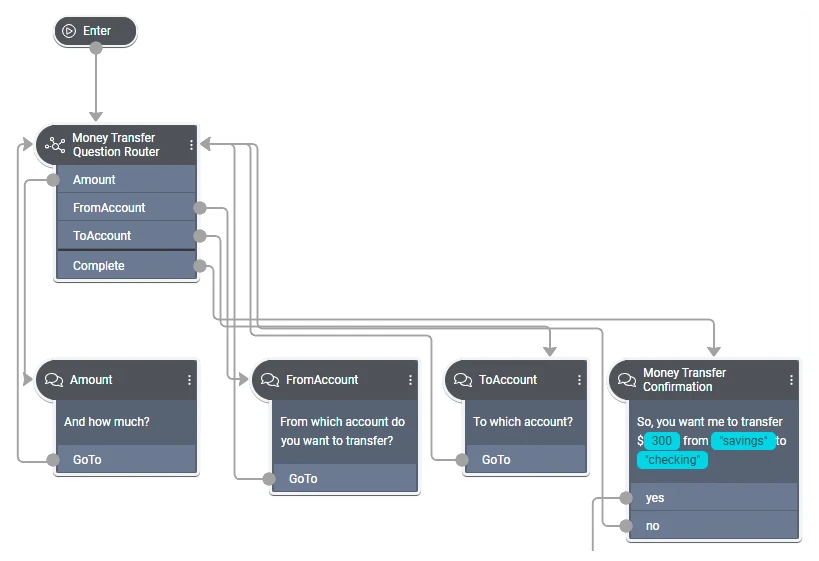

Innovate personalized customer experiences

As an innovative and forward-thinking organization, Valencia CF is continuously improving the global fan experience and building new connections with their fans. Using Microsoft Dynamics 365, the club gained new and actionable insights and a deeper understanding of its fans. With an integrated data architecture, Valencia can run personal campaigns with its season ticket holders. From deploying an app to speed food orders in the stadium to checking in with 1,500 season ticket holders who missed in-person games during the COVID-19 lockdowns, Valencia has used the insights from its customer data to create delightful, rewarding, and engaging fan experiences. By applying custom Al on top of the unified data, the club was able to predict which season ticket holders were most likely to attend games. For those who missed two consecutive games, Valencia CF reached out with a tailored email. And for a subsegment of the fans, football legends Ricardo Arias and Miguel Angel Bossio, who played for Valencia CF in the 80s and 90s, made personal calls.

“Imagine the older fans’ reactions when their all-time favorite idol calls to say hi and see how things are goingit’s an unforgettable experience. It also gave us the opportunity to sincerely thank our fans and hear firsthand what’s on their mind. Customer insights helped us engage at the right moment with a meaningful personal touch that deepened the relationship and strengthened loyalty.”Franco Segarra, Innovation Director, Valencia CF.

Take a look at how Valencia CF leveraged customer data and technology to create amazing fan experiences.

This embed requires accepting cookies from the embed’s site to view the embed. Activate the link to accept cookies and view the embedded content.

Valencia CF demonstrates that transforming a casual fan into a super fan is about delighting and engaging that fan on a one-to-one basis.

Super fans are increasingly important in the world of sports brands. Building the commitment of the super fan is not just about tradition and generational influence. It’s about data, and more specifically, drawing all the diverse data sources into one platform driving innovation. But we are only at the beginning of this data journey, and Microsoft is the partner enabling sports teams all over the world to discover the exciting possibilities when the power of integrated data is unleashed.

Next steps

- Read how Microsoft helped Valencia CF unlock the value of their customer data to create super fans.

- Learn more about the Microsoft Customer Experience Platform.

The post Data empowers Valencia CF to create personalized fan experiences appeared first on Microsoft Dynamics 365 Blog.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

Recent Comments