Today, we are excited to announce the general availability of tax calculation for Microsoft Dynamics 365.

Over the past three decades, technology has made the world smaller. The steady drive of globalization and digitalization has pushed through significant headwindssuch as market protectionism, global recessions, and, most recently, a global pandemicto change the way we live and conduct business. Now, despite vast geographic distances, it is relatively simple to connect, communicate, and trade instantly with almost anyone. This has set the stage for businesses of all sizes and industries to expand globally in pursuit of new markets, suppliers, talent, and revenue streams.

As businesses pursue global expansion, they are challenged to keep pace with a myriad of ever-evolving country-specific laws and frequently changing legal requirements from local, state, and national tax authorities. For many years, the only option available for business leaders looking to ensure tax compliance globally was to hire enough full-time finance and tax professionals to monitor policy changes and align company processes accordingly. Indeed, this has been the standard solution for some time now.

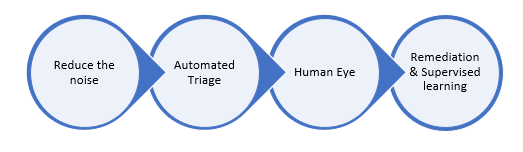

Microsoft Dynamics 365 is changing this situation for companies with intelligent and timely globalization solutions, such as tax calculation. Tax calculation not only helps businesses unify their tax-relevant data, but it also leverages automation to make their tax calculation processes more efficient. At the same time, it assists in minimizing compliance risk by reducing opportunities to introduce errors into the process. In these ways, our new tax calculation service is simplifying and improving tax compliance for global businesses.

Learn more in our recent blog: Reduce complexity across global operations with Dynamics 365

Tax calculation service overview

Tax calculation is a low code, hyper-scalable, multitenant, microservice-based tax engine that enables organizations to automate and simplify the tax determination and calculation process. It is a standalone solution built on Microsoft Azure that enhances tax determination and calculation capabilities of Dynamics 365 applications through a flexible and fully configurable solution.

As tax calculation becomes generally available, it will integrate with Dynamics 365 Finance and Dynamics 365 Supply Chain Management, and we plan to integrate with more first and third-party applications in the near future. Additionally, it is fully backward compatible with the existing tax engine in Dynamics 365 Finance and Dynamics 365 Supply Chain Management and can be deployed as a new feature in the Feature Management workspace. Tax calculation service can also be enabled at more granular levels, including by legal entity or business process.

Tax determination

One challenge for organizations today is determining the appropriate tax for their business transactions. This challenge increases in difficulty as organizations add new regions where they trade and as the volume and types of transactions they process grows.

Tax calculation configures and determines tax codes, rates, and deductions in a low code and flexible way based on any combinations of the fields of a taxable document, such as shipping to or from location address, item category, or nature of counterparty, typically found on purchase orders or invoices.

Tax calculation

Another related challenge that companies face in addition to determination is calculating the tax due for their transactions. Again, this challenge becomes more difficult as business scale increases and as business is conducted in more distinct tax regions, each with its own authorities and requirements.

Our tax calculation service helps businesses meet this challenge as well by configuring with low code experience and executing the complex tax calculation formulas and conditions required by tax regulators, such as tax calculation based on margin or tax calculation on top of other tax codes.

Multiple tax registration numbers

Organizations also face challenges when they have multiple tax registration numbers that must be rolled up or reconciled to one central legal entity or party. When businesses add multiple tax registration numbers, the complexity of tax determination and calculation multiplies in step.

Tax calculation enables organizations to support multiple tax registration numbers under a single party, such as a legal entity, customer, or vendor. It also supports automatic determination of the correct tax registration number on taxable transactions like sales orders and purchase orders. And it works across various workflow scenarios, including transfer pricing, consignment warehouse, or low-risk distributor model.

In conjunction with new tax calculation, modified Tax Reporting provides new capabilities to execute country-specific, tax regulatory reports like VAT Declaration, EU Sales List, and Intrastat from a single legal entity. In multiple tax registration business scenarios, the reports select sets of data only relevant for transactions with specific country tax registration and provide results in the legally required form of an electronic file or a report layout required to file taxes in the country of tax registration.

Learn more about the feature enhancements of Tax Reporting and availability for specific countries and regions in our release notesand TechTalk.

Tax on transfer orders

A final challenge that businesses face when confronting the complexities and risk of tax compliance in foreign markets is determining and calculating the tax on transfer orders. This situation is quite common, such as when a business has a regional manufacturing facility or central warehouse that feeds storefronts scattered across multiple countries.

With tax calculation, businesses can allow for tax on transfer orders to support the EU regulation “Exempt intra-EU supply according to article 138 of the Directive 2006/112/EC” for Intra-EU Supply of goods.

Availability

Tax calculation is deployed in the following Azure geographies.

- Asia Pacific

- Australia

- Canada

- Europe

- Japan

- United Kingdom

- United States

Learn more about the features of tax calculation service inour tax calculation overview, and check out our recent TechTalk on tax calculation.

Learn more what some of our partners are saying about the new tax calculation capabilities of Dynamics 365:

Next steps

If you are an existing Dynamics 365 user and would like to start today with tax calculation and Tax Reporting, check out our Get started with tax calculation documentation. Or, if you would like to see how Dynamics 365 Finance can benefit your company and enable smoother global expansion with microservice solutions such as tax calculation and Tax Reporting, we invite you to get started with a free trial today.

The post Tax calculation enhancements are now available for Dynamics 365 appeared first on Microsoft Dynamics 365 Blog.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

Recent Comments