This article is contributed. See the original author and article here.

The record to report (R2R) process is foundational to financial transparency and compliance, encompassing activities such as accounting policy definition, cash management, journal entries, reconciliations, variance analysis, financial close, and reporting. However, these processes are often manual and complex, leading to extended close cycles and data integrity challenges.

To streamline R2R operations, finance teams are increasingly adopting AI-powered agents. These agents accelerate tasks like document summarization across systems—such as audit reports, contracts, and lease agreements—and assist with time-intensive, period-end activities like reconciliations and variance analysis. According to the Microsoft Work Trends Index 2025 report, The Rise of the Frontier Firm, 68% of finance leaders identified automation as a top priority for improving accuracy and speed in the close process, while 72% reported a reduction in manual effort since adopting AI-powered solutions. As a result, finance professionals can shift their focus from routine tasks to more strategic analysis and decision-making, fundamentally transforming the way financial operations are managed and enabling businesses to stay agile in fast-moving markets.

Microsoft has introduced several first-party ERP agents designed specifically to streamline and enhance finance and operations. These agents are seamlessly integrated within the Microsoft ERP ecosystem, automating tasks such as account reconciliation, expense management, and supplier communications. Through a combination of first-party (1P), third-party (3P), and custom-built agents, let’s delve into real-world applications of ERP agents, highlighting how organizations can automate, optimize, and elevate to enter R2R lifecycle.

Agentic ERP Solutions

Drive growth with an enterprise resource planning (ERP) solution that streamlines operations and decisions.

Understanding the agent landscape

Before diving into the impact AI and agents have on R2R, it’s important to distinguish between the three agent types:

- 1P agents are developed and maintained by Microsoft and embedded directly into Microsoft 365 and Dynamics 365 experiences. Examples include the Account Reconciliation Agent, the financial reconciliation and variance analysis features in the Finance solution, and Time and Expense Agent. These agents are purpose-built for high complexity scenarios, encompassing a variety of edge cases or patterns.

- 3P agents are partner-owned services that operate within or alongside Microsoft ecosystems such as Dynamics 365 and Microsoft 365 and often use industry or function specific expertise. Due to their integration with Microsoft platforms and access to data across the organization, these agents are subject to additional compliance and governance requirements, including Microsoft 365 Certification, data protection policies, and administrative controls.

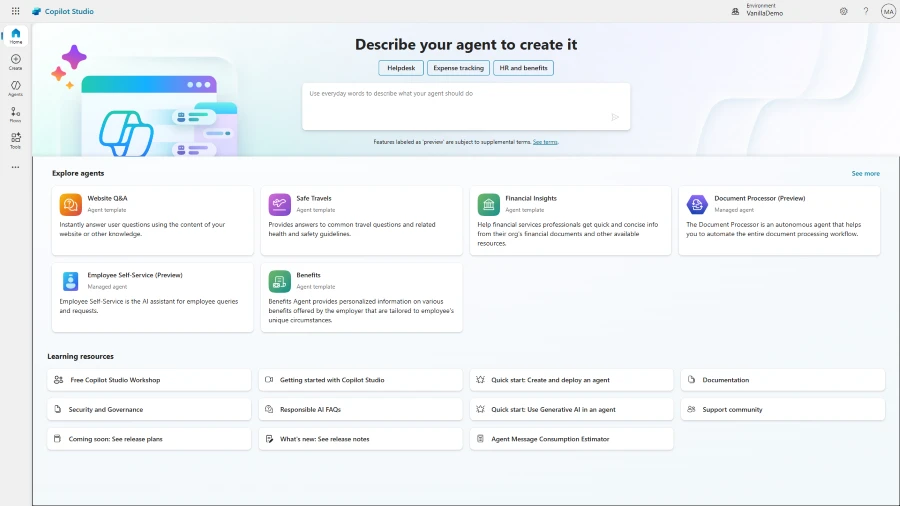

- Custom agents can be built using Microsoft Copilot Studio or Azure AI, tailored to specific business or user needs. Using natural language and knowledge sources, customers can quickly build agents that offer deep orchestration, multi-agent coordination, and integration with external systems like SAP, Oracle, or proprietary ERPs.

Each type plays a unique role in supporting R2R, and together they form a powerful toolkit for finance transformation.

Automating reconciliation with 1P agents

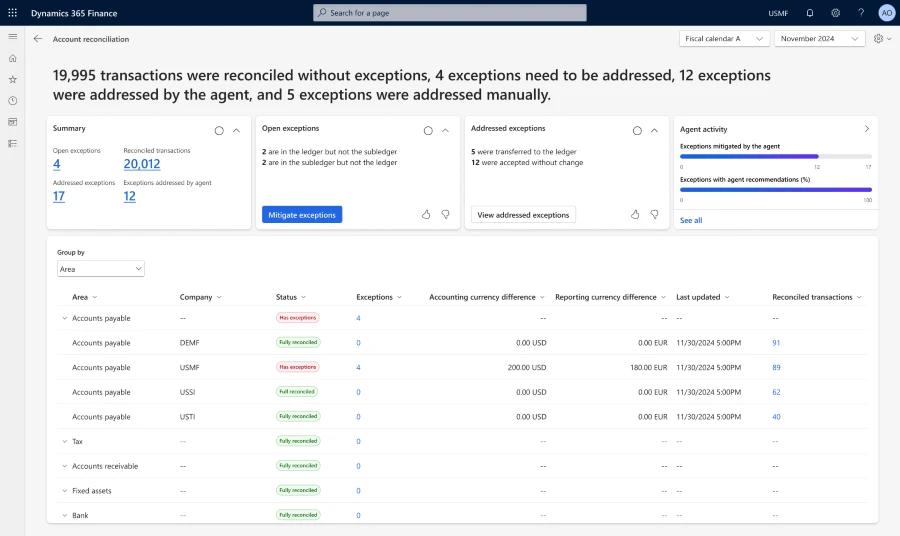

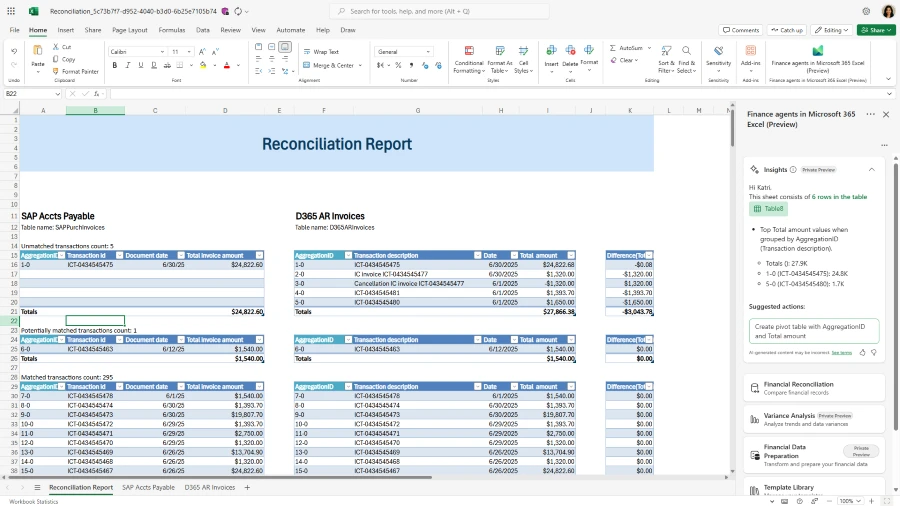

One of the most time-consuming tasks in R2R is reconciliation—whether it’s matching transactions between subledgers and general ledgers or reconciling bank statements and intercompany balances. The Financial Reconciliation Agent, a 1P solution, has already demonstrated its value in reducing manual effort and improving auditability.

Users can initiate reconciliation directly from Excel, define matching logic, apply tolerances, and generate detailed reports. Templates allow for repeatable automation, and agents can be triggered by events like file uploads or scheduled runs. Organizations like U.S. AutoForce have reported time savings of up to 80% using these agents.

Driving insight with the finance solution in Microsoft 365 Copilot

Variance analysis is critical for understanding deviations between actuals and forecasts. The variance analysis capabilities, available in Microsoft 365 Copilot, enables finance teams to perform multi-dimensional analysis across products, regions, and time periods. It supports both natural language queries and structured prompts and can generate executive summaries and actionable insights.

These role-based solutions are particularly useful during month-end close, budgeting cycles, and performance reviews. By automating variance detection and explanation, agents can free analysts to focus on strategic decision-making.

Extending capabilities with 3P agents

Microsoft is accelerating the development of out-of-the-box finance agents by collaborating with our partner ecosystem to deliver finance-specific solutions through the AppSource framework. These agents are purpose-built in response to direct customer feedback, ensuring they address real-world financial challenges with precision and relevance.

Among the standout examples is the Lease Agent developed by Crowe, which automates lease data extraction and validation, and seamlessly integrates with Dynamics 365 Finance to streamline the lease accounting processes. Another impactful solution is the PayFlow Agent by HSO, designed to eliminate the repetitive task of responding to vendor payment inquiries. Operating behind the scenes, it analyzes incoming emails, retrieves real-time data from Dynamics 365 Finance, and delivers accurate responses within seconds.

These are just two of many 3P agents currently in development, with more expected to launch in the coming months.

Extending capabilities with custom agents

While 1P and 3P agents offer robust out-of-the-box functionality, many organizations require deeper customization. Enter custom agents, built in Microsoft Copilot Studio or Azure AI Foundry. These agents can:

- Connect to external systems through Model Context Protocol (MCP) servers, APIs, or OData connectors.

- Perform write-back operations (such as creating journal entries in ERP.)

- Orchestrate multi-step workflows across departments.

- Comply with enterprise-grade security and governance standards.

Examples include agents that monitor service disruptions, generate alerts, and initiate corrective actions; or agents that automate work item creation in DevOps based on finance triggers.

Custom agents are ideal for complex workflow automation, advanced need, or when integrating with legacy systems or handling complex business logic.

Real-world impact across the R2R lifecycle

Let’s map agent capabilities to key R2R stages:

| R2R stage | AI type | Agent functionality |

| Journal entry | Custom agent | Create entries based on triggers or reconciled data. |

| Reconciliation | 1P agent | Automate ledger matching, generate reports, and notify users. |

| Variance analysis | 1P Copilot | Analyze deviations, generate summaries, and suggest corrective actions. |

| Close management across multiple systems | Custom agent | Coordinate tasks, validate data, and escalate issues. |

| Financial reporting | 1P or custom agent | Aggregate data, apply formatting, and distribute reports. |

| Audit and compliance | 1P or custom agent | Preserve original data, ensure traceability, and support audit workflows. |

This alignment shows how agents can support both tactical execution and strategic oversight.

Unlock your financial potential with agents

The convergence of 1P, 3P, and custom agents marks a new era for finance operations. By automating routine tasks, surfacing insights, and enabling intelligent workflows, agents empower finance teams to focus on what matters most—strategic decision-making and value creation.

As organizations embrace AI-first transformation, the R2R process stands to benefit immensely from agentic innovation. Whether you’re just starting or scaling your deployment, now is the time to explore how agents can reshape your finance function.

The post Reinventing business process with AI: Agents in record to report appeared first on Microsoft Dynamics 365 Blog.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

Recent Comments