This article is contributed. See the original author and article here.

How the Advanced Tax Calculation Engine Supports Businesses in a Time of Change

Brazil’s sweeping tax reform is reshaping indirect taxation and creating new compliance demands for companies of all sizes. To help organizations prepare, Microsoft is introducing the Brazilian Tax Reform solution in Dynamics 365 Finance—a flexible, transparent, and compliance-ready approach designed to support modern enterprises.

Dynamic Flexibility: Preparing for Reform with Confidence

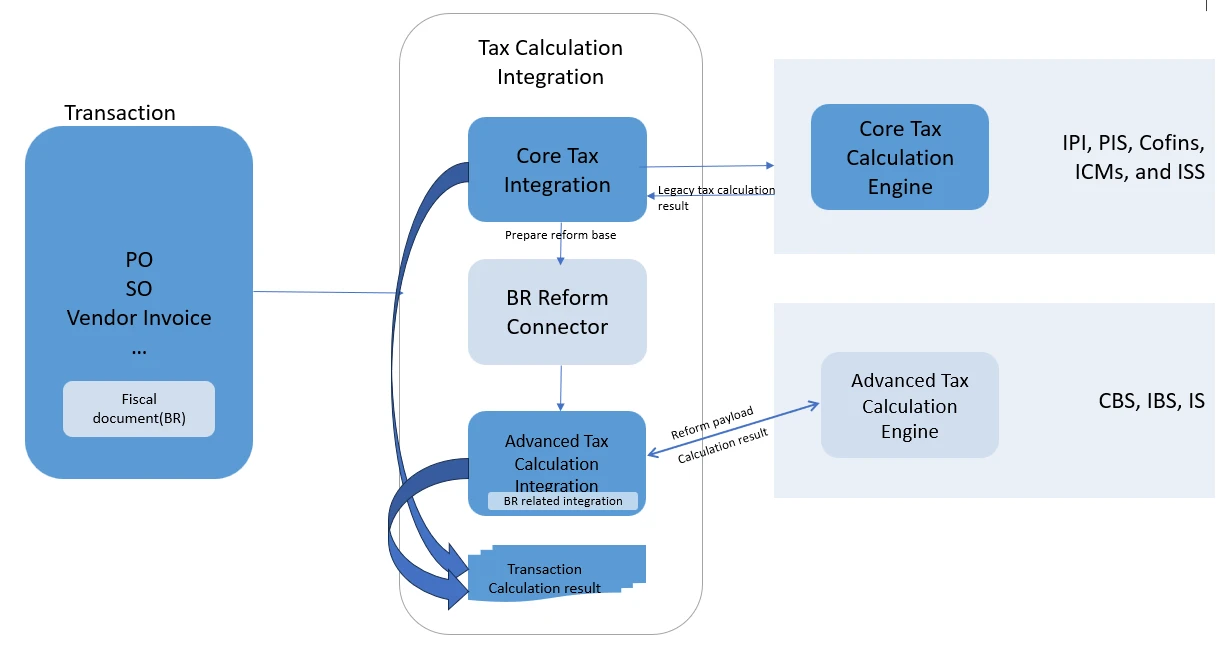

At the core of the solution is the Advanced Tax Calculation engine, which enables organizations to configure, test, and run both legacy and new tax regimes in parallel during the transition period. This approach supports continuity, allowing businesses to adopt reform at their own pace while minimizing disruption or downtime.

Figure 1: Legacy core tax plus Advanced Tax Calculation engine

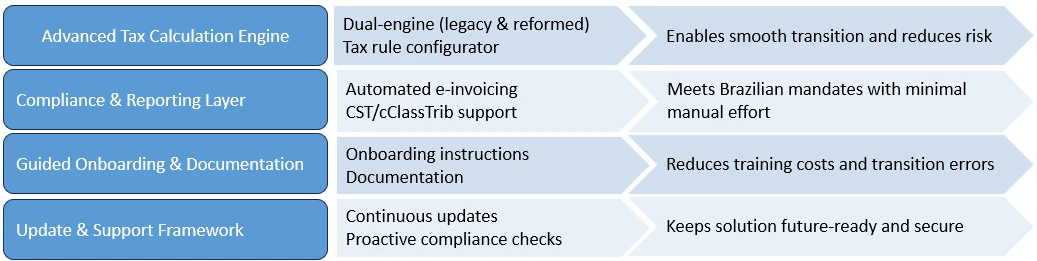

Practical Tools for Day-to-Day Compliance

The Brazilian Tax Reform solution provides intuitive tools that simplify setup and ongoing operations. Users can:

- Define tax groups and rules

- Manage NF-e updates and new CST/cClassTrib fields

- Configure electronic invoicing in Electronic Reporting aligned with Brazilian requirements

Clear documentation and guided configuration help minimize errors and improve readiness for future regulatory changes.

Continuous Compliance with Built-In Updates

Tax reform is not a one-time change—it will continue to evolve. Dynamics 365 Finance Globalization delivers updates as requirements shift, reducing the need for long upgrade projects. This continuous compliance model ensures businesses remain current with legislation and better prepared for future adjustments.

Solution Architecture for Agility

The Brazilian Tax Reform solution is built on a modern, extensible data model that adapts as regulations change:

- Tax Engines: Legacy and reform engines can operate side by side only during the transition period to support migration.

- Entity-Centric Tax Rules: Flexible definitions for tax groups, item groups, and conditional tax logic.

- Electronic Invoicing: Updated NF-e and new NFS-e formats are generated through Electronic Reporting. NF-e continues via SEFAZ; NFS-e submission requires customization or third-party integration.

- Built-In Compliance: Automated updates, audit trails, and reporting to support transparency and regulatory alignment.

Figure 2: Brazilian Tax Reform Solution Structure

Conclusion: A Practical Path Forward

The Brazilian Tax Reform solution in Dynamics 365 Finance gives organizations the flexibility and tools they need to manage compliance confidently. With dual tax engines available only during the transition period, flexible configuration, and continuous updates, the solution supports a smooth shift to Brazil’s new requirements while maintaining operational continuity.

This solution is designed not only to meet today’s compliance needs but also to help businesses stay adaptable in the face of ongoing regulatory change.

The post Introducing the Brazilian Tax Reform Solution in Microsoft Dynamics 365 Finance appeared first on Microsoft Dynamics 365 Blog.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

Recent Comments