Release wave 1 expands agility, automation, and innovation across Microsoft Dynamics 365 and Power Platform

This article is contributed. See the original author and article here.

Today we launched 2023 release wave 1 for Microsoft Dynamics 365 and Microsoft Power Platform, a rollout of new features and enhanced capabilities slated for release between April and September 2023.

The updates include Copilot for Dynamics 365 and Copilot for Microsoft Power Platform, bringing the power of next-generation AI capabilities and natural language processing to business processes. Release wave 1 also introduces hundreds of new and updated user experiences to collaboratively solve challenges, streamline workflows, and help individuals and teams focus on what matters most.

The 2023 Microsoft Business Applications Launch Event, available to view on demand, is a great way to get up to speed on the release wave and learn how organizations are already using these capabilities to transform end-to-end business processes today.

Some of the major themes that we’re excited to highlight include:

- Enhancing end-to-end customer experiences with AI and Dynamics 365 Copilot.

- Modernizing every link across supply chain and operations.

- New ways to accelerate development with Microsoft Power Platform.

Enhancing end-to-end customer experiences with AI

Release wave 1 supercharges end-to-end customer experiences while improving collaboration and information sharing across the organization. New capabilities provide more insight into audiences’ needs, and more ways to engage customers with personalized content and conversations at scale. AI takes center stage in this release wave, with new Dynamics 365 Copilot capabilities that help to streamline processesfrom audience research to content development.

For example, automaker Lynk & Co. is attracting new customers to its innovative, membership-based approach to car ownership by using new AI capabilities in Dynamics 365, as well as enhancements to build relationships with the right audience. Learn more in this fireside chat with Lynk & Co by visiting the bonus content during the Microsoft Business Applications Launch Event.

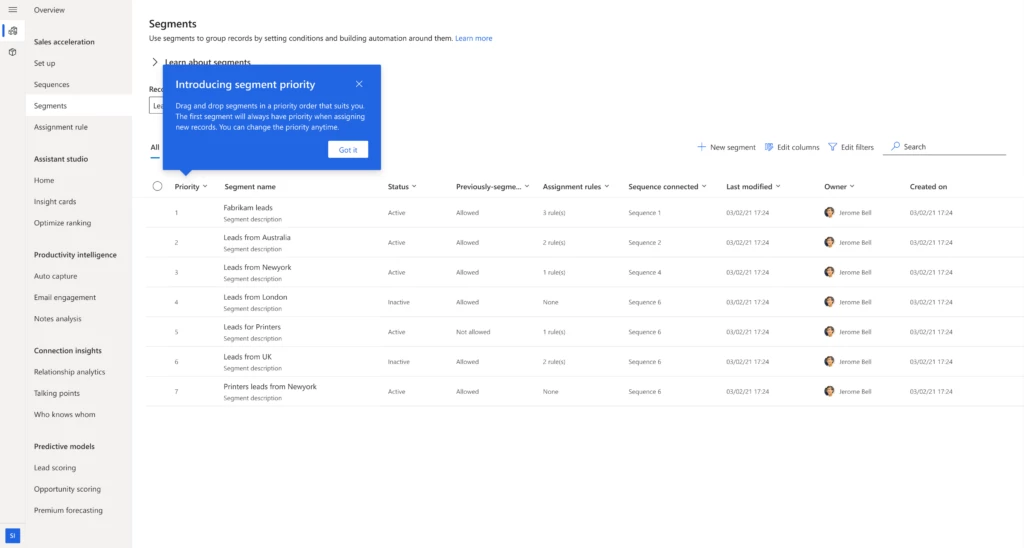

Dynamics 365 Customer Insights will enable marketers at organizations like Lynk & Co. to use natural language capabilities in Copilot to query, group, and measure their customer data, allowing them to discover hidden patterns. Marketers can quickly identify the best audience for upcoming events and create a segment directly from the results.

In addition, users can see all Customer Insights activities in the unified activity timeline in Dynamics 365 Sales, Customer Service, and Marketing. Valuable data from Customer Insights can be embedded directly within the Contact, Account, and Lead forms within Dynamics 365 Sales, giving sellers a more complete picture of their customer in the flow of work.

Explore the release plans for Dynamics 365 Customer Insights.

Dynamics 365 Marketing delivers Copilot capabilities to help marketers learn more about their customers, create targeted customer segments, and generate personalized content. We’ve enhanced the query assist feature with generative AI capabilities, enabling marketers to accurately target customers using conversational, everyday language to quickly build targeted segments. Content ideas helps to find inspiration and provide a starting point for copy when composing emails for audiences.

We’ve also made it easier to add lead capture forms to a website. With the new intuitive forms experience in real-time marketing, you can easily create modern forms with advanced capabilities without depending on developers. Also, marketers can use out-of-the-box dashboards to track pipeline development and analyze the impact and contribution of journeys, marketing messages, and content at different stages of the business process.

Explore the release plans for Dynamics 365 Marketing.

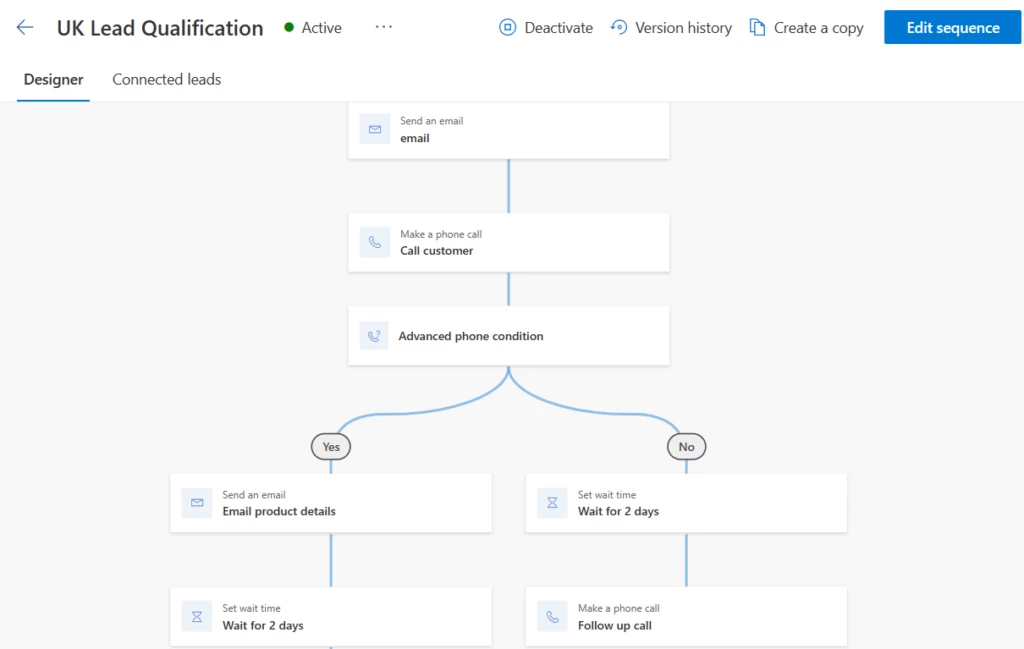

Dynamics 365 Sales delivers enhancements to streamline seller tasks and improve effectiveness. Rather than manually tracking next steps, Dynamics 365 Sales helps sellers to automate the creation of follow-up tasks. This saves valuable time to focus on higher-priority items and avoid tasks from falling through the cracks. Copilot in Dynamics 365 Sales creates email content for faster customer replies and AI-generated meeting follow-ups that compile discussed topics.

In addition, updates include a new manager insights dashboard for conversation intelligence, as well as extended support for conversation intelligence with calls made through third-party telephony providers. This gives sellers a seamless experience irrespective of the call provider they are using.

See the release plans for Dynamics 365 Sales and Microsoft Viva Sales.

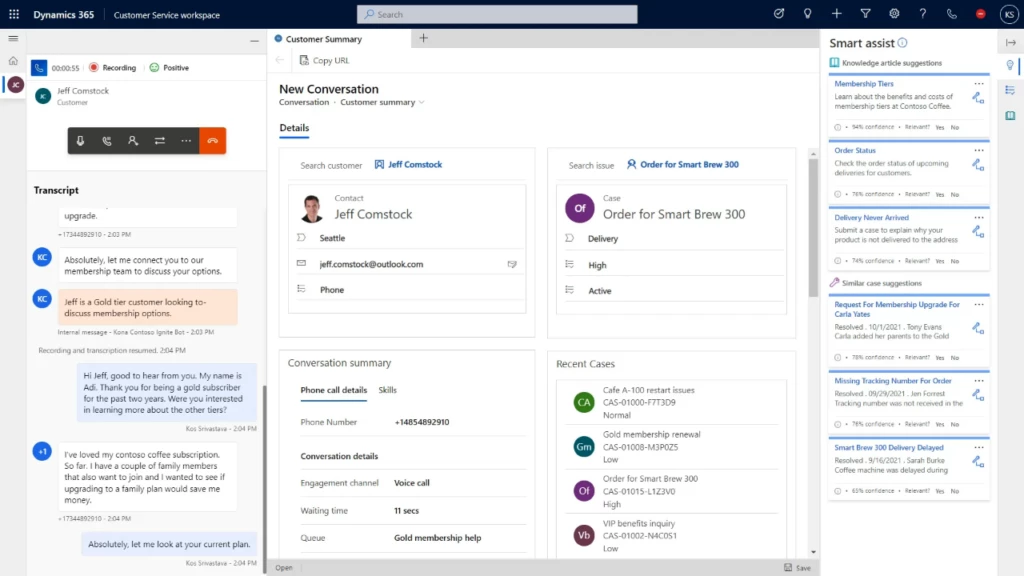

Release wave 1 updates for Dynamics 365 Customer Service include enhanced case creation, channel-based swarming with Microsoft Teams, and robust real-time analytics with customization, in addition to availability of the voice channel in more regions.

Organizations like MVP Health Carea nationally-recognized regional not-for-profit health plan providerwill soon use Copilot in Dynamics 365 Customer Service to provide agents with real-time AI-powered assistance, helping them to resolve issues faster, handle cases more efficiently, and automate time-consuming tasks so they can focus on delivering high-quality service to their customers.

Explore the release plans for Dynamics 365 Customer Service.

Modernize every link across supply chain and operations

Updates to Dynamics 365 Supply Chain Management deliver increased agility and resilience across the supply chain. By applying appropriate valuation methods and selected currencies, you can now account inventoriesinventory and work in progress (WIP)in multiple representations, to help comply with local generally accepted accounting principles (GAAP), internal management accounting, and International Financial Reporting Standards (IFRS) principles.

A new Asset Management mobile app helps ensure smooth operation of production equipment. From one app, your team can create new maintenance requests, track and update work orders, and access key information. Updates to the Warehouse Management mobile app include a new version for iOS devices and features to speed the packing process, such as optimized screen layouts with more prominent product images to help workers more quickly identify items.

Dynamics 365 Intelligent Order Management is officially included in Microsoft Supply Chain Center, helping to provide faster, more reliable delivery times. Updates include the ability to create a purchase order from a sales order and check order status updates without switching to Dynamics 365 Supply Chain Management, as well as new purchase orders for business-to-business (B2B) capabilities. At the launch event, we demonstrate new capabilities that help organizations like Northern Tool + Equipmenta manufacturing and omnichannel retail business with 130 stores across the United Statesto experience faster, more reliable delivery times, so their customers get the tools and supplies they need exactly when they expect.

See the release plans for Dynamics 365 Supply Chain Management, Intelligent Order Management, and the Microsoft Supply Chain Center.

Dynamics 365 Finance and Project Operations

In this wave of updates, we’re helping finance organizations adapt faster, work smarter, and drive business performance with features and enhancements focused on the three As of rapid finance-first innovation.

Organizations like The Robert Walters Group, a specialist recruitment agency operating in 31 countries, can now use our newly generally available Expense mobile app. The release wave 1 updates also include expense itemization and the ability to capture receipts using optical character recognition (OCR), enter per diems, and log mileage.

Enhancements for Dynamics 365 Finance include further automation of complex tax scenarios and full end-to-end automation of accounts payable and ledger settlements, helping finance professionals to expedite the close and spend more time focusing on value-added activities.

See the release plans for Dynamics 365 Finance, Project Operations, and Human Resources.

Accelerate development with Power Platform

Microsoft Power Platformour comprehensive and intelligent low-code platformenables users and organizations to create innovative apps, bots, and automations seamlessly. In our launch event, we explore how customers like Pacific Gas and Electric (PG&E) use Microsoft Power Platform to automate and eliminate redundant and manual processes throughout their organization.

This release wave builds on our commitment to create tools and experiences that add value to every role by breaking down silos between data, insights, and people. The union of AI and low-code will revolutionize the way solutions are built and fundamentally transform the way people work, collaborate, and create.

With Power Apps, we continue to support the scaling of organizations by empowering makers and developers of all skill levels to be more productive and to build apps, and manage data and logic. We are helping organizations reduce risk with advanced governance capabilities, such as automated tests for custom pages and model-driven apps, enabling customers to further benefit from modernization of web and mobile experiences ensuring modern and fast experiences across apps.

See the release plans for Power Apps.

Power Pages supports low-code and no-code makers, as well as professional developers, with more out-of-the-box capabilities, like new solution-based application life cycle management and migration of website configurations from one environment to another. With virtual tables and cloud flow integration, Power Pages can now connect seamlessly to your external data and service and enable both low-code makers and pro developers to build amazing user experiences.

Explore what’s new for Power Pages.

Power Automate is reimagining the process of creating flows with natural language authoring capabilities that allow you to simply describe the flow you want to create. It has never been easier for new users to start creating and authoring flows. Other improvements include introducing work queues where automatable tasks can be viewed and managed together, as well as providing streamlined connectivity to a machine for desktop flows, which eliminates the need for additional installs and password management. Lastly, we’re making it easier for organizations to contextualize the impact of their technical investments with ROI performance tracking capabilities in Power Automate desktop flows, which helps organizations invest in the most valuable automation efforts.

Explore what’s new for Power Automate.

Power Virtual Agents is the Microsoft single conversational AI studio and unified authoring canvas for all bot-building needs. We’re making it easier for developers and makers to build bots with Copilot in Power Virtual Agents, greatly accelerating bot development via natural language authoring. Developers can then extend their bots to handle more complex workloads with Microsoft Bot Framework and Microsoft Azure Cognitive Services capabilities in Power Virtual Agents.

Explore what’s new for Power Virtual Agents.

Power BI infuses AI-driven insights into everywhere that people get work done. For Teams, we’re bringing enhancements to meetings and multitasking to help users work with their data wherever they may be. And, for individuals, we’re enhancing the creation experience, bringing more parity on the web, and adding the Power Query diagram view into Power BI.

Explore the release plans for Power BI.

Watch the virtual Microsoft Business Applications Launch Event

We encourage you to watch the launch event on demand for more details and demos of new capabilities across Dynamics 365 and Microsoft Power Platform. In addition, you can explore several special topic presentations covering Microsoft Dynamics 365 Business Central, Physical Operations, and our AI transformation journey in business applications.

Be sure to explore the detailed release plans for Dynamics 365 and Microsoft Power Platform, and keep track of what’s new and upcoming, as well as create a personalized release plan, in the release planner.

Release planner

Explore Dynamics 365 and Microsoft Power Platform features coming soon or available to try now.

The post Release wave 1 expands agility, automation, and innovation across Microsoft Dynamics 365 and Power Platform appeared first on Microsoft Dynamics 365 Blog.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

Recent Comments