by Scott Muniz | Feb 3, 2022 | Security

This article was originally posted by the FTC. See the original article here.

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

Credit freezes

A credit freeze is the best way you can protect against an identity thief opening new accounts in your name. When in place, it prevents potential creditors from accessing your credit report. Because creditors usually won’t give you credit if they can’t check your credit report, placing a freeze helps you block identity thieves who might be trying to open accounts in your name.

A freeze also can be helpful if you’ve experienced identity theft or had your information exposed in a data breach. And don’t let the “freeze” part worry you. A credit freeze won’t affect your credit score or your ability to use your existing credit cards, apply for a job, rent an apartment, or buy insurance. If you need to apply for new credit, you can lift the freeze temporarily to let the creditor check your credit. Placing and lifting the freeze is free, but you must contact the national credit bureaus to lift it and put it back in place.

Place a credit freeze by contacting each of the three national credit bureaus, Equifax, Experian, and TransUnion. A freeze lasts until you remove it.

Fraud alerts

A fraud alert doesn’t limit access to your credit report, but tells businesses to check with you before opening a new account in your name. Usually, that means calling you first to make sure the person trying to open a new account is really you.

Place a fraud alert by contacting any one of the three national credit bureaus. That one must notify the other two. A fraud alert lasts one year and you can renew it for free. If you’ve experienced identity theft, you can get an extended fraud alert that lasts for seven years.

Learn more about credit freezes, fraud alerts, and active duty alerts for service members. And, if identity theft happens to you, visit IdentityTheft.gov to report it and get a personal recovery plan.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

by Scott Muniz | Feb 3, 2022 | Security, Technology

This article is contributed. See the original author and article here.

CISA has released an Industrial Controls Systems Advisory (ICSA) that details vulnerabilities in the Airspan Networks Mimosa product line. An attacker could exploit these vulnerabilities to achieve remote code execution, create a denial-of-service condition, or obtain sensitive information.

CISA encourages users and administrators to review ICSA-22-034-02: Airspan Networks Mimosa for more information and apply the necessary mitigations.

by Scott Muniz | Feb 3, 2022 | Security, Technology

This article is contributed. See the original author and article here.

Cisco has released security updates to address vulnerabilities in Cisco Small Business RV160, RV260, RV340, and RV345 Series Routers. A remote attacker could exploit some of these vulnerabilities to take control of an affected system. For updates addressing lower severity vulnerabilities, see the Cisco Security Advisories page.

CISA encourages users and administrators to review Cisco advisory cisco-sa-smb-mult-vuln-KA9PK6D and apply the necessary updates.

by Scott Muniz | Feb 2, 2022 | Security, Technology

This article is contributed. See the original author and article here.

Google has released Chrome versions 98.0.4758.80/81/82 for Windows and 98.0.4758.80 for Mac and Linux. These versions address vulnerabilities that an attacker could exploit to take control of an affected system.

CISA encourages users and administrators to review the Chrome Release Note and apply the necessary updates.

by Scott Muniz | Feb 2, 2022 | Security

This article was originally posted by the FTC. See the original article here.

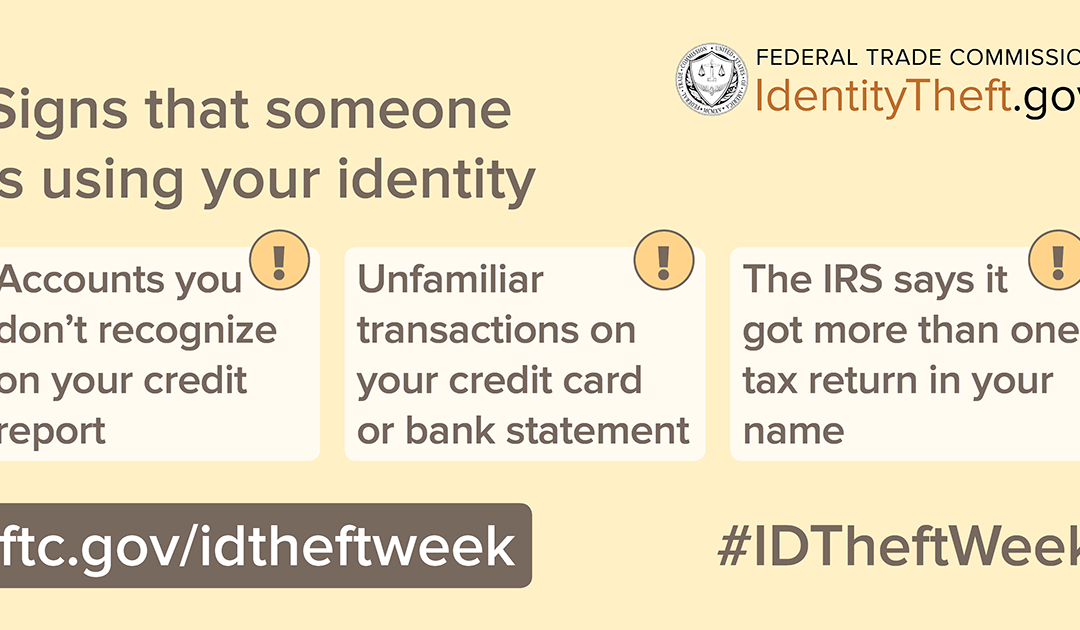

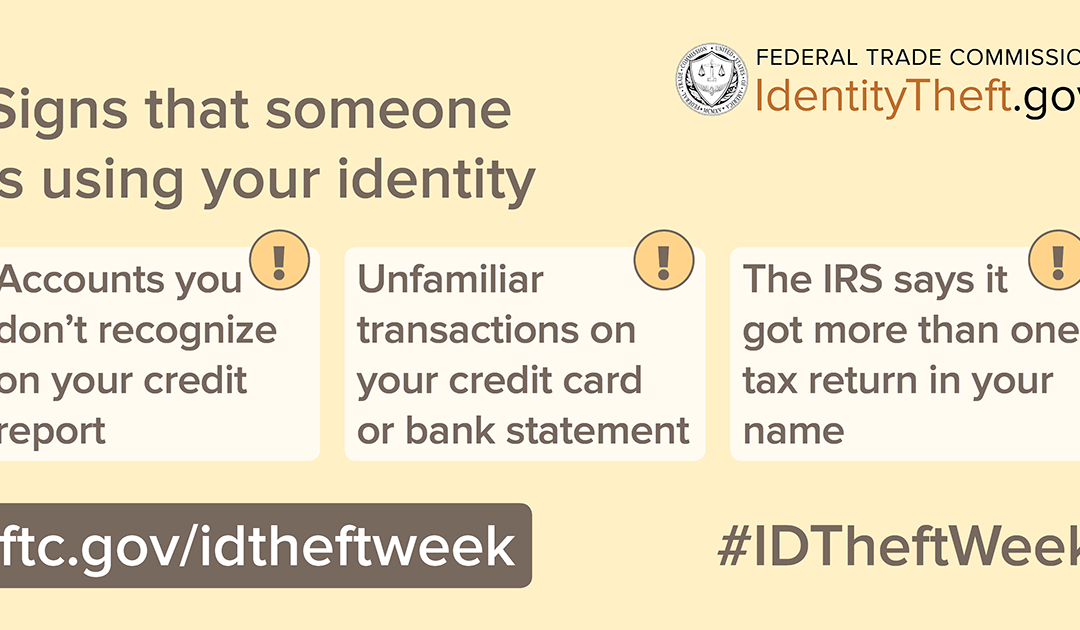

Taking steps to protect your personal information can help you minimize the risks of identity theft. But what if a thief gets your information anyway? Here are some of the ways thieves might use your stolen information and signs you can look out for.

An identity thief could use your information to get credit or service in your name.

-

How to spot it: Get your free credit report at AnnualCreditReport.com. Review it for accounts you didn’t open or inquiries you don’t recognize. A new credit card, a personal loan, or a car loan will appear as a new account. A new cell phone plan or utility service — like water, gas, or electric — will show up as an inquiry.

An identity thief could use your credit card or take money out of your bank account.

- How to spot it: Check your credit card or bank statement when you get it. Look for purchases or withdrawals you didn’t make.

- Bonus advice: Sign up to get text or email alerts from your credit card or bank whenever there’s a new transaction. This could help you spot unauthorized or fraudulent activity on your account.

An identity thief could steal your tax refund or use your Social Security number to work.

- How to spot it: A notice from the IRS that there’s more than one tax return filed in your name could be a sign of tax identity theft. So could a notice that you have income from an employer you don’t work for.

An identity thief could use your health insurance to get medical care.

- How to spot it: Review your medical bills and Explanation of Benefits statements for services you didn’t get. They could be a sign of medical identity theft.

An identity thief could use your information to file a claim for unemployment benefits.

- How to spot it: A notice from your state unemployment office or employer about unemployment benefits that you didn’t apply for could be a sign of fraud.

If you discover any signs that someone is misusing your personal information, find out what to do at IdentityTheft.gov.

And remember to check out our daily free events and webinars with our co-partners during Identity Theft Awareness Week.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

Recent Comments