by Scott Muniz | Feb 14, 2022 | Security

This article was originally posted by the FTC. See the original article here.

Chocolates, flowers, and spending time with your special someone are all Valentine’s Day traditions, but what about helping a friend or loved one spot and avoid a romance scam?

Chocolates, flowers, and spending time with your special someone are all Valentine’s Day traditions, but what about helping a friend or loved one spot and avoid a romance scam?

Even though a romance scam might not be affecting you, someone you know might be facing one. According to a new FTC report, people sent $547 million to online romance scammers last year. And more than a third of those who lost money said the contact started on Facebook or Instagram, often through an unexpected private message.

So pick up the phone and reach out to someone you might not have spoken with in a while. Check in with them, see how they’re doing, and listen to what they say. You might just be able to help them spot and avoid a romance scam.

As you start a conversation, here are some things to keep in mind:

- If a friend or loved one mentions an online love interest, ask if they’ve met in person.

- If they haven’t met in person, but that love interest has asked for money, that’s a scam. Period. No matter what story they tell — even if they send you money or gifts first.

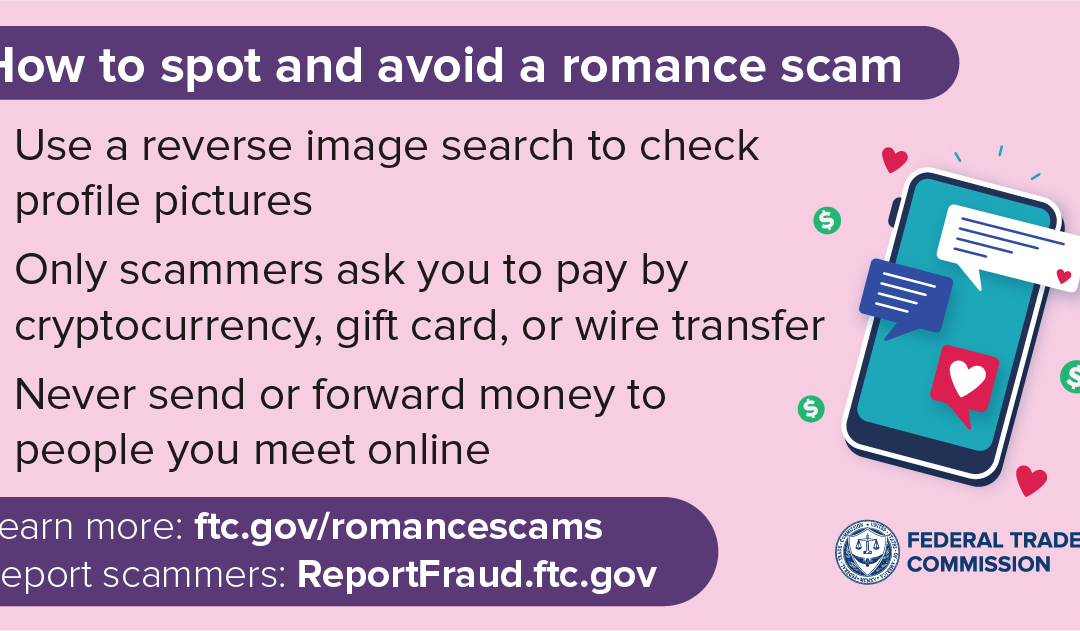

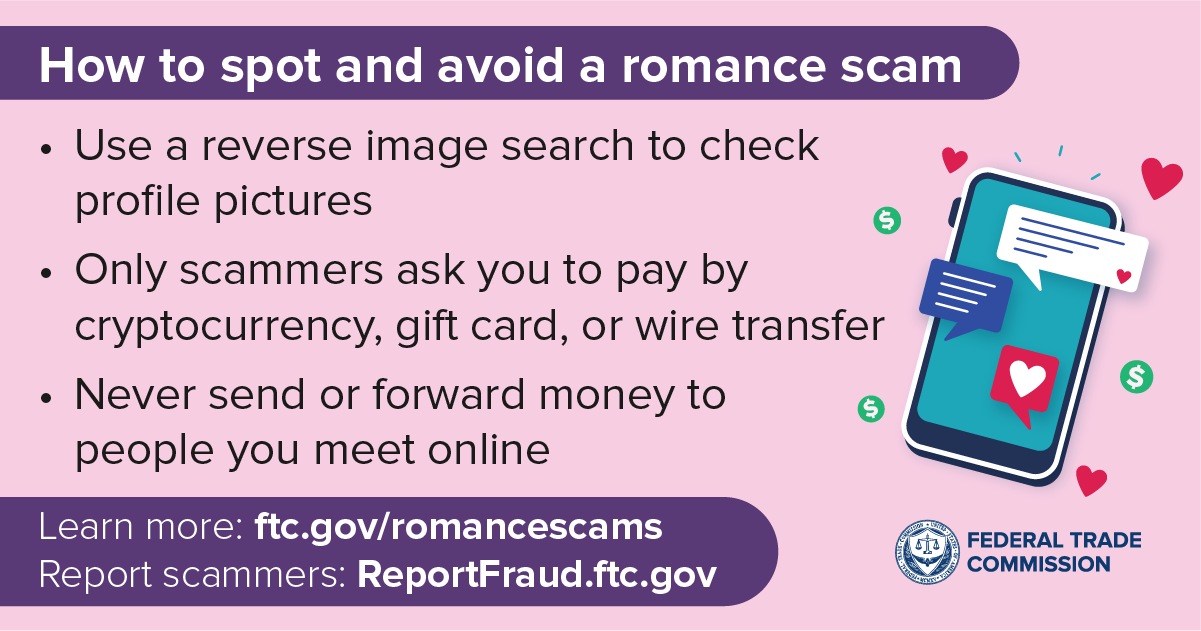

- Romance scammers often create fake profiles. Use a reverse image search to see if someone else has used that profile picture, or if the details don’t match up.

- Never send or forward money to people you meet online. And only scammers ask you to pay by cryptocurrency, gift cards, or wire transfer.

Learn more at ftc.gov/romancescams and report scammers at ReportFraud.ftc.gov

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

by Scott Muniz | Feb 11, 2022 | Security, Technology

This article is contributed. See the original author and article here.

CISA has added one new vulnerability to its Known Exploited Vulnerabilities Catalog, based on evidence that threat actors are actively exploiting the vulnerability listed in the table below. These types of vulnerabilities are a frequent attack vector for malicious cyber actors of all types and pose significant risk to the federal enterprise.

| CVE Number |

CVE Title |

Remediation Due Date |

|

CVE-2022-22620

|

Apple Webkit Remote Code Execution Vulnerability

|

2/25/2022

|

Binding Operational Directive (BOD) 22-01: Reducing the Significant Risk of Known Exploited Vulnerabilities established the Known Exploited Vulnerabilities Catalog as a living list of known CVEs that carry significant risk to the federal enterprise. BOD 22-01 requires FCEB agencies to remediate identified vulnerabilities by the due date to protect FCEB networks against active threats. See the BOD 22-01 Fact Sheet for more information.

Although BOD 22-01 only applies to FCEB agencies, CISA strongly urges all organizations to reduce their exposure to cyberattacks by prioritizing timely remediation of Catalog vulnerabilities as part of their vulnerability management practice. CISA will continue to add vulnerabilities to the Catalog that meet the meet the specified criteria.

by Scott Muniz | Feb 11, 2022 | Security, Technology

This article is contributed. See the original author and article here.

Official websites use .gov

A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS

A

lock ( )

) or

https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

by Scott Muniz | Feb 10, 2022 | Security

This article was originally posted by the FTC. See the original article here.

Reports to the FTC, analysis of data from FTC enforcement actions, and research have shown that people living in majority Black communities are disproportionately harmed by fraud and other consumer problems. Racial discrimination has led to structural barriers to accessing credit, housing, and income-generating opportunities, especially in Black communities. The FTC has brought enforcement actions and provided consumer education to address various issues that adversely affect communities of color, such as discriminatory auto financing, predatory lending, inaccuracies related to tenant screening and credit reporting, deceptive student debt relief operations, shady debt collection practices, and phony money-making opportunities.

But the FTC knows there is much more to do, and we are committed to strategically using our resources to center racial equity and economic equality in our work. Check out the Serving Communities of Color Report to find out more, but looking forward, the FTC will focus on:

- Working to increase reporting of fraud and other consumer problems to the FTC.

- Bringing enforcement actions that shut down frauds that target or disproportionately affect communities of color and combat discriminatory and other problematic practices.

- Strengthening and broadening relationships with trusted resources in communities of color and looking for new approaches to place consumer protection messages where people already are – physically, in the media, and online.

- Increasing the systematic review and analysis of consumer reports to the FTC and data from enforcement actions to identify trends and disparities that negatively impact communities of color to help us better focus our work.

Advancing racial equity is critical to the FTC’s consumer protection mission. Targeted law enforcement, working with trusted sources, and insightful research are just a few components of how the FTC will better serve communities of color.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

by Scott Muniz | Feb 10, 2022 | Security

This article was originally posted by the FTC. See the original article here.

Love happens year-round, not only on Valentine’s Day. Unfortunately, romance scams are the same. So, along with sharing (or not) some chocolate, make Valentine’s Day a time to share with people you care about some ways to spot and avoid romance scams. Because, according to a new FTC report, people sent $547 million to online romance scammers last year.

While many of the people who told the FTC they were defrauded said they were contacted on a dating app, romance scammers found them on social media, too. In fact, more than a third of the people who lost money to an online romance scam said the contact started on Facebook or Instagram, often through an unexpected private message.

Romance scammers typically spin complicated stories to convince people to send money. In 2021, people reported scammers asking them to send money for one (imaginary) health or financial crises after another. Other scammers pretended to be successful cryptocurrency investors and used romance to lure people into sending money for bogus investments.

Scammers ask to get paid in ways that let them get money quickly and anonymously. In 2021, about one in four people used a gift card to send money to a romance scammer. The most money was reported lost — $139 million — through payments made in cryptocurrency.

How can you avoid a romance scam?

- If someone appears on your social media and rushes you to start a friendship or romance, slow down.

- Don’t send a reload, prepaid, or gift card; don’t wire money; and don’t send cryptocurrency to someone you met online.

- If you suspect a romance scam, cut off contact. Tell the online app or social media platform right away, and then tell the FTC at ReportFraud.ftc.gov.

Brought to you by Dr. Ware, Microsoft Office 365 Silver Partner, Charleston SC.

Chocolates, flowers, and spending time with your special someone are all Valentine’s Day traditions, but what about helping a friend or loved one spot and avoid a romance scam?

Chocolates, flowers, and spending time with your special someone are all Valentine’s Day traditions, but what about helping a friend or loved one spot and avoid a romance scam?

Recent Comments