by Contributed | Sep 10, 2024 | Technology

This article is contributed. See the original author and article here.

If you work in smartcard federated authentication environments, here’s a much-anticipated security feature for you. Starting with the September 10, 2024 Windows security update, you can use strong name-based mapping on Windows Server 2019 and newer. This feature helps you with the hardening changes for certificate-based authentication on Windows domain controllers.

What are weak and strong mappings in Active Directory?

All certificate names must be correctly mapped onto the intended user account in Active Directory (AD). If there’s a likelihood that they aren’t, we call these mappings weak. Weak mappings give rise to security vulnerabilities and demand hardening measures such as Certificate-based authentication changes on Windows domain controllers.

Following up on our May 2022 round of updates to address these vulnerabilities, we’re introducing a new feature called strong name-based mapping. You can now distinguish between “strong” and “weak” mappings within existing Alternative Security Identities (AltSecIDs) based on likelihood. With the new feature, you can allow some weak name-based mappings to be treated as strong name-based mappings. You just need to properly configure both the public key infrastructure (PKI) and the AD deployment.

Key features and benefits of strong name-based mapping

Strong name-based mapping has two main benefits:

- Compliance with strong certificate mapping enforcement. Strong name-based mapping allows certain weak certificate mappings, such as Issuer/Subject AltSecID and User Principal Names (UPN) mappings, to be treated as strong mappings. This type of strong mapping is compatible with the enforcement mode of certificate-based authentication changes on Windows domain controllers.

- Compatibility with government PKI deployments. Strong name-based mappings work by asking PKI deployments to attest certain security guarantees of certificates via object identifiers (OIDs) stamped on the certificate. It’s a common practice among government PKI and AD deployments.

Security requirements for PKI deployments for strong name-based mapping

Warning

Unless you have a strong need for this type of deployment AND have a deep knowledge of how PKI deployments and AD authentication interact together, we DO NOT recommend deploying strong name-based mapping. We instead recommend that you following the guidance in KB5014754: Certificate-based authentication changes on Windows domain controllers.

Fundamentally, strong name-based mapping deployment is your promise to Microsoft that your PKI is not susceptible to the attacks addressed by May 2022 and later updates. Namely, you take responsibility for the vulnerabilities that can arise from any unintentional mapping of the names in a certificate to multiple AD accounts.

To prevent unintentional and unsafe mappings, we recommend that you take steps to strengthen your PKI and AD deployments. Some of these steps include:

- Names used in either the Subject Name and/or the Subject Alternative Name of certificates MUST NOT contain names that are queried and/or built from AD.

- Names used in either the Subject Name and/or the Subject Alternative Name of certificates MUST be both immutable and globally unique to the entire PKI deployment.

- AD and PKI administrators must ensure that certificate issuance for logons is not automatic. Instead, ensure that strong manual checks are in place to prevent a certificate with an incorrect or clashing name from being issued.

Failing to secure your PKI and AD deployments can degrade the security of your environment.

If your PKI meets or exceeds these security requirements, you MUST add an OID in the Issuance Policy of the certificate to denote this compliance. This OID (or multiple OIDs) will be used further below in the strong name-based mapping configuration.

Setup instructions

To enable strong name-based mapping on Windows Server 2019 and later, you need to take the following steps:

- Enable the Group Policy (GPO) Setting on the Domain Controllers:

Computer Configuration > Administrative Template > System > KDC > “Allow name-based strong mappings for certificates”.

- Configure the GPO with the necessary tuples (more details below).

This configuration relies on adding tuples to the GPO when strong name-based mapping is enabled. These tuples tell the Domain Controller which certificates meet the above security requirements by specifying both the Issuer certificate authority (CA) thumbprint and the OID(s) that denote that the PKI deployment is secured against the May 2022 vulnerabilities. Furthermore, the tuples also configure which “weak” name-based mappings can be upgraded to “strong” name-based mappings.

The tuple is in the following format:

;;

- Issuer CA Certificate Thumbprint: This is the certificate thumbprint of the Issuing CA. There can only be one Issuer CA Thumbprint in this field. If multiple Issuer CA Thumbprints are placed, it can prevent proper processing of the GPO policy.

- OID(s): This is a comma-separated list of OIDs that the PKI deployment has stamped on the certificate to attest that the security requirements against name collisions have been met. There can be multiple OIDs denoted in this field.

- IssuerSubject/UpnSuffix: This is a comma-separated list to denote what type of weak mapping should be treated as strong:

- IssuerSubject: This string behaves as a tag to denote that the Issuer/SubjectName AltSecID can be upgraded from “weak” to “strong.” There can only be one IssuerSubject tag in this field.

- UPNSuffix: This string denotes that certificate mappings can be upgraded form “weak” to “strong” wherever the UPN suffix of the SubjectName (that is, everything that comes after the @ symbol) matches the suffix in the tuple exactly. There can be multiple UPN suffixes in this field.

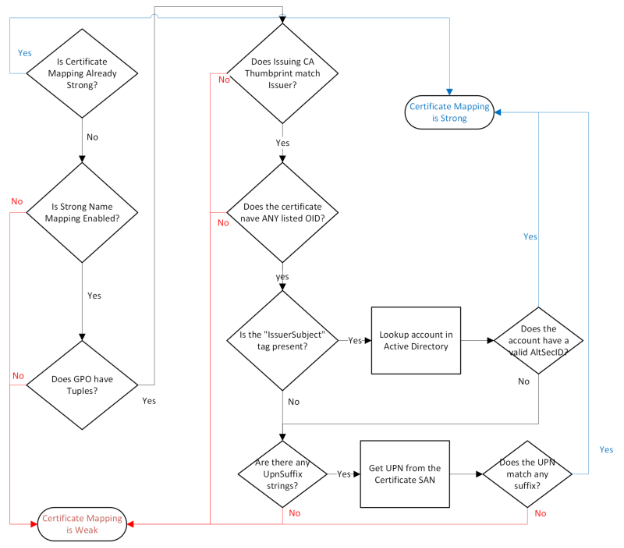

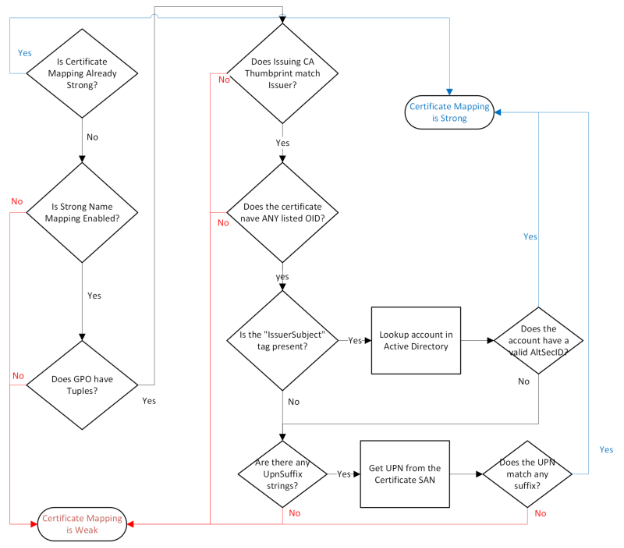

The logic of the tuple is the following. For certificates whose Issuer is X that has any of the OID(s) Y, upgrade any of the weak mappings C to “strong.” This logic is summarized in the diagram.

Flow chart illustrating the logic of strong name-based mapping configuration. The chart starts with a decision diamond asking if the certificate’s Issuer Certificate Thumbprint matches the specified thumbprint. If yes, it proceeds to check if the certificate has any of the specified OIDs. If both conditions are met, it allows a strong mapping for the certificate based on either Issuer/SubjectName AltSecID or UPNSuffix, depending on the configuration.

Flow chart illustrating the logic of strong name-based mapping configuration. The chart starts with a decision diamond asking if the certificate’s Issuer Certificate Thumbprint matches the specified thumbprint. If yes, it proceeds to check if the certificate has any of the specified OIDs. If both conditions are met, it allows a strong mapping for the certificate based on either Issuer/SubjectName AltSecID or UPNSuffix, depending on the configuration.

Two important configuration details are required for UPN Suffix mapping to work:

- Certificates must have the UPN of the user in the SAN.

- Mapping via UPNs has not been disabled via UseSubjectAltName.

How to use and understand policy tuples: a walkthrough

Policy tuple example 1

Use this policy tuple to allow a strong mapping via Issuer/SubjectName AltSecID.

fe40a3146d935dc248504d2dcd960d15c4542e6e; 2.16.840.1.101.3.2.1.3.45;IssuerSubject

- For certificates whose Issuer Certificate Thumbprint is fe40a3146d935dc248504d2dcd960d15c4542e6e, and

- The certificate has the OID 2.16.840.1.101.3.2.1.3.45,

- Allow a strong mapping if the certificate is mapped via Issuer/SubjectName AltSecID.

This tuple would allow a certificate logon which passes checks (1) and (2) issued to the user Bob, if the AD object for Bob has the Issuer/SubjectName AltSecID correctly configured for the certificate.

Policy tuple example 2

Use this policy tuple to allow a strong mapping via a specified UPNSuffix.

fe40a3146d935dc248504d2dcd960d15c4542e6e; 2.16.840.1.101.3.2.1.3.45;UPNSuffix=corp.contoso.com

- For certificates whose Issuer Certificate Thumbprint is fe40a3146d935dc248504d2dcd960d15c4542e6e, and

- The certificate has the OID 2.16.840.1.101.3.2.1.3.45,

- Allow a strong mapping if the certificate is mapped via UPNSuffix, which should be “corp.contoso.com.”

This tuple would allow a certificate logon which passes checks (1) and (2) issued to the user Bob, if the AD object for Bob has the Issuer/SubjectName AltSecID correctly configured for the certificate.

Policy tuple example 3

Use this policy tuple to allow a strong mapping via any of the approved specifications.

fe40a3146d935dc248504d2dcd960d15c4542e6e; 2.16.840.1.101.3.2.1.3.45, 2.16.840.1.101.3.2.1.3.44;UPNSuffix=corp.contoso.com,UPNSuffix=my.corp.contoso.com,IssuerSubject

- For certificates whose Issuer Certificate Thumbprint is fe40a3146d935dc248504d2dcd960d15c4542e6e, and

- The certificate has ANY of the following OIDs:

- 2.16.840.1.101.3.2.1.3.45

- 2.16.840.1.101.3.2.1.3.44

- Allow a strong name-based mapping if the certificate is mapped via either of the following:

- The user account in AD has a valid Issuer/SubjectName AltSecID mapping

- UPNSuffix, where the suffix is “corp.contoso.com”

- UPNSuffix, where the suffix is “my.corp.contoso.com”

Event Log changes

Two Event Log updates are here to help you as an AD administrator better troubleshoot strong name-based mapping scenarios. These are available to you with the September 10, 2024 and later updates.

Updates to current event logs

The current event logs now include policy OIDs found on the certificate used for authentication. This modifies the Key Distribution Center (KDC) events introduced by the May 10, 2022 and later updates.

New event logs

Additionally, a new event is available to log when the strong name-based mapping GPO encounters an issue processing the policy tuples. Track these events through Event ID 311.

Event Log

|

Microsoft-Windows-Kerberos-Key-Distribution-Center/Operational

|

Event Type

|

Error

|

Event Source

|

Kerberos-Key-Distribution-Center

|

Event ID

|

311

|

Event Text

|

The Key Distribution Center (KDC) encountered invalid certificate strong name match policy.

Faulting line:

|

Ready to improve Windows Server security?

We’re excited to bring this feature to your government scenario. Consider strong name-based mappings on Active Directory and PKI deployments in Windows Server 2019 or later if you meet the security requirements and recommendations. If you have any questions or need assistance, our support team is here to help.

Continue the conversation. Find best practices. Bookmark the Public Sector Tech Community, then follow us on the Public Sector Blog for updates.

by Contributed | Sep 9, 2024 | Technology

This article is contributed. See the original author and article here.

The new semester is just beginning, and over the past few months, we’ve enhanced Copilot with exciting new features to support your quiz creation. With the capabilities like generating detailed answer explanations for each question, rewriting questions, and smart suggestions for fine tuning the quiz. Copilot is now more powerful than ever. Let’s explore how these updates can help you create quizzes more effectively and efficiently this semester.

Please note that a Copilot for Microsoft 365 license is required to access the following features.

Generate quiz draft based on prompt/pasted content

You can specify your intentions, such as the quiz subject, audience, types of questions, and more to generate a quiz. Besides, Copilot can also generate a quiz from pasted content, such as a paragraph in textbook. For example, as a middle school teacher, you could instruct Copilot to create a physics quiz for 9th grade students or simply copy and paste content from a textbook to generate the quiz.

Generate quiz draft based on prompt

Generate quiz draft based on prompt

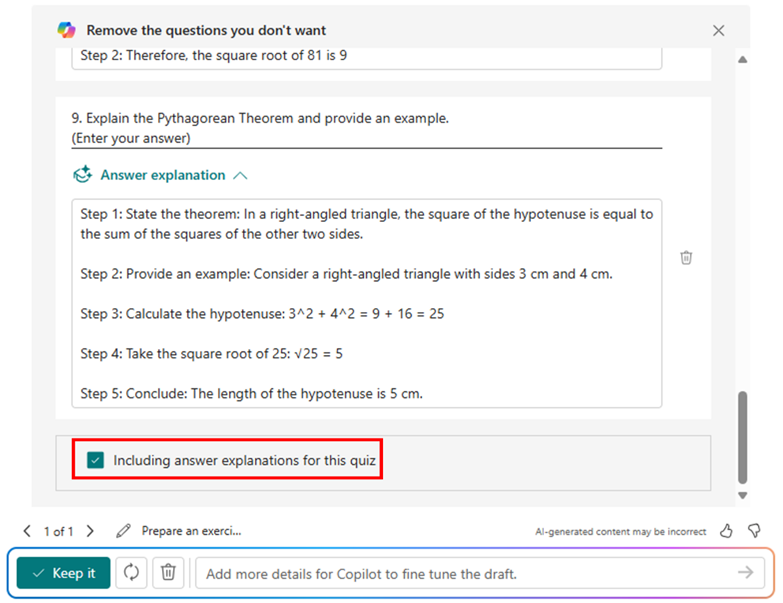

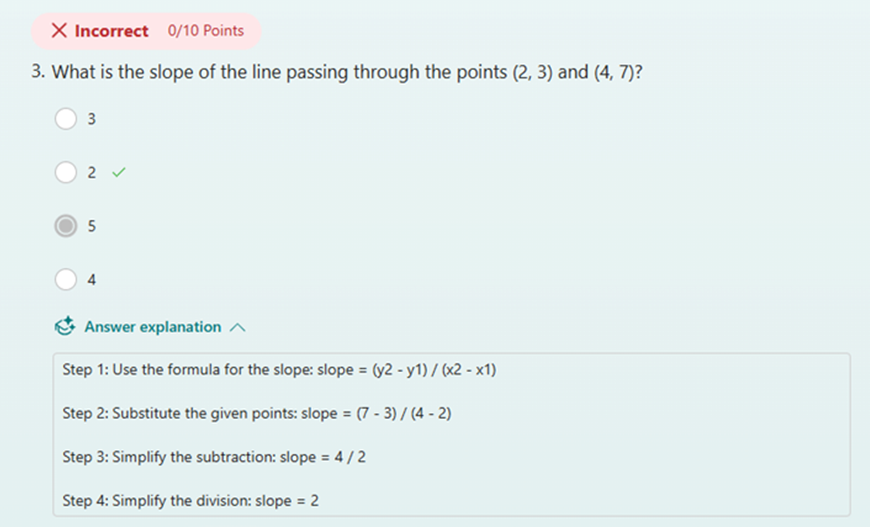

Quiz draft with answer explanations

After the quiz draft is generated, if you select “Including answer explanations,” each question will come with detailed explanations to clarify the reasoning behind the correct answers. You can review the solutions for each question and keep the draft to use. As shown below, when we are generating a math quiz for grade 9 students, Copilot shows us the step-by-step solutions to calculate the correct answer.

Step-by-step answer explanation

Step-by-step answer explanation

Further instructions to refine the draft

You have the flexibility to add/remove questions and refine the draft further by providing additional details to Copilot. For instance, if you forgot to include trigonometric questions in a math quiz, you could keep asking to add two questions on that topic.

Further instructions to refine the draft

Further instructions to refine the draft

Rewrite questions and answer explanations

Once you keep the draft to use, if you need to do further modifications on questions, options or the answer explanation, you can easily rewrite it with Copilot’s assistance. For example, you can make the question easier or add more details to the answer explanation for better clarity. You can also manually customize the answer explanations as needed.

Rewrite answer explanations

Rewrite answer explanations

Generate answer explanation for newly created questions

After adjusting the generated questions, if you still need to add new ones, Copilot can help by generating answer explanations based on the correct answers you mark, saving you time on manual input.

Generate answer explanation for newly created questions

Generate answer explanation for newly created questions

Copilot smart suggestions

Before sending out the quiz, Copilot will offer suggestions to enhance its quality. You can add a fun theme to boost students’ motivation and enthusiasm, adjust settings such as time duration and practice mode, and choose appropriate distribution channels like sharing via URL or presenting live. With just one click, you can apply these suggestions to create a more engaging and effective quiz.

Copilot smart suggestions

Copilot smart suggestions

Immediate results and answer explanation for responders

When respondents submit the quiz, they can view the results immediately and review the answer explanations to understand which areas they already mastered or where they could improve.

Check result with answer explanations after submitting

Check result with answer explanations after submitting

Hope you find these new features useful for the new semester. Discover more about Copilot for Microsoft 365 here.

by Contributed | Sep 7, 2024 | Technology

This article is contributed. See the original author and article here.

Question Description:

A customer has designed a database schema for a Terabyte-level Azure SQL database, but the original design lacks a unique key. As the data volume increases, performance issues become more pronounced.

- To address these performance issues, Azure SQL uses a hidden index with uniqueifier identifiers, which have a maximum limit of 2,147,483,648.

- When the number of data rows in a table exceeds 2.1 billion, any insert or update operations will result in the following error:

Msg 666, Level 16, State 2, Line 25

This error can lead to partial or complete database outages, severely impacting business operations.

It isn’t a good idea to create a clustered index on a uniqueidentifier column and generate your GUIDs with NEWID(). The reason for this is that NEWID() generates GUIDs in non-sequential order and SQL Server orders a clustered index sequentially. It will work – SQL Server will let you build a clustered index around a uniqueidentifier column, however it will cause the SQL Server to do unnecessary work and cause performance slowdowns. The reason for this is that to insert data into the middle of a clustered index (out of sequential order) causes SQL Server to make room for the data by rearranging the cluster.

Mitigation Strategies:

1. Quick Workaround:

- Make index creation online and resumable by specifying ONLINE=ON and RESUMABLE=ON. This allows the operation to use smaller transactions, making it possible to resume from the failure point if it fails for any reason.

2. Permanent Fix:

- Rebuild the clustered index with a unique key by adding a new column. The steps are as followed:

- I: Create the index with the new definition offline.

- II: Use the DROP_EXISTING option for online index creation. This keeps both indexes up-to-date, and once the new index is built, it will replace the existing one.

- III: Use the resumable option to break the creation into smaller transactions, reducing transaction log bloat. Note that there is some performance impact.

- IV: Manually create a new copy of the table, copying all cold data, then rename the table. This involves scanning the source table, adding a small additional load to the system. Use a shorter outage and a merge statement for the new data.

- V: Create a partitioned view that is a union of the old and new tables with different index schemes. Ensure that insert statements supply values for every field in the table. This method can be complex and may require taking the database offline, with the rebuilding process taking anywhere from a few hours to several days.

Best Practice:

Planning early and carefully designing the clustered index is crucial to avoid these issues.

References

- uniqueidentifier

- How to design clustered index

- Create a clustered index

by Contributed | Sep 7, 2024 | Technology

This article is contributed. See the original author and article here.

As you may be aware, Azure Automation Agent-based User Hybrid Runbook Worker (Windows and Linux) was retired on 31 August 2024, and support has been discontinued.

For guidance on migrating, please refer to this article: Migrate an existing agent-based hybrid workers to extension-based-workers in Azure Automation | Microsoft Learn

Nonetheless, users might want to verify whether their runbooks and jobs are utilizing the extension or agent-based system when they transition. It’s worth noting that versions V1 and V2 of the same hybrid worker machine can be registered simultaneously with Azure Automation but will have different names.

If the V1 agent wasn’t uninstalled before the V2 extension was installed, this would lead Azure to detect both versions on the same machine.

The “last seen time” suggests V1 and V2 are communicating with Azure Automation if both exist.

It’s also worth noting that some automation tasks are still being performed by the V1 worker, which accounts for its continued activity. Runbook jobs can be executed on any machine within the Hybrid Worker Group. Currently, this group includes both V1 and V2 versions, so the tasks are distributed between them.

The installation of V2 does not mean that the Hybrid Worker Group will disregard V1 and exclusively use V2.

Happy Learning!

by Contributed | Sep 6, 2024 | Technology

This article is contributed. See the original author and article here.

In my previous blog posts of containerising .NET apps and Function apps, I discussed how to containerise .NET apps and Azure Functions apps with and without Dockerfile. However, deploying these containerised apps to Azure Container Apps (ACA) is a different story.

Since its release in May 2023, Azure Developer CLI (azd) has evolved significantly. azd nowadays even automatically generates Bicep files for us to immediately provision and deploy applications to Azure. With this feature, you only need the azd up command for provisioning and deployment.

Throughout this post, I’m going to discuss how to provision and deploy .NET apps including Azure Functions to ACA through just one command, azd up.

You can find a sample code from this GitHub repository.

Prerequisites

There are a few prerequisites to containerise .NET apps effectively.

Running the app locally

The sample app repository already includes the following apps:

Let’s make sure those apps running properly on your local machine. In order to run those apps locally, open three terminal windows and run the following commands on each terminal:

# Terminal 1 – ASP.NET Core Web API

dotnet run –project ./ApiApp

# Terminal 2 – Azure Functions

cd ./FuncApp

dotnet clean && func start

# Terminal 3 – Blazor app

dotnet run –project ./WebApp

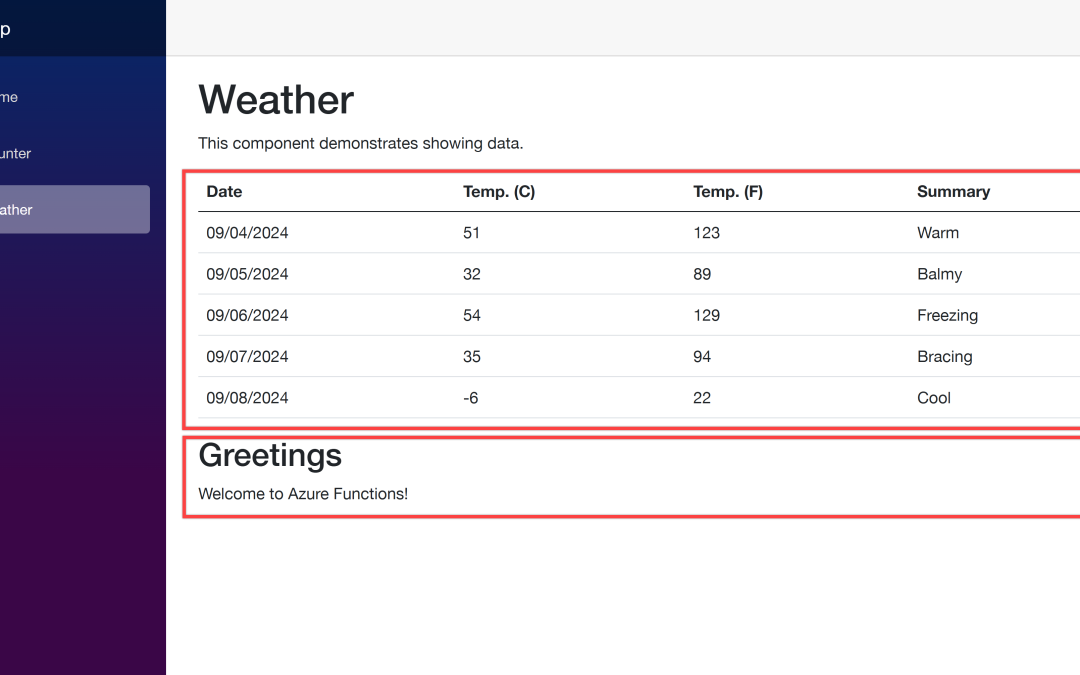

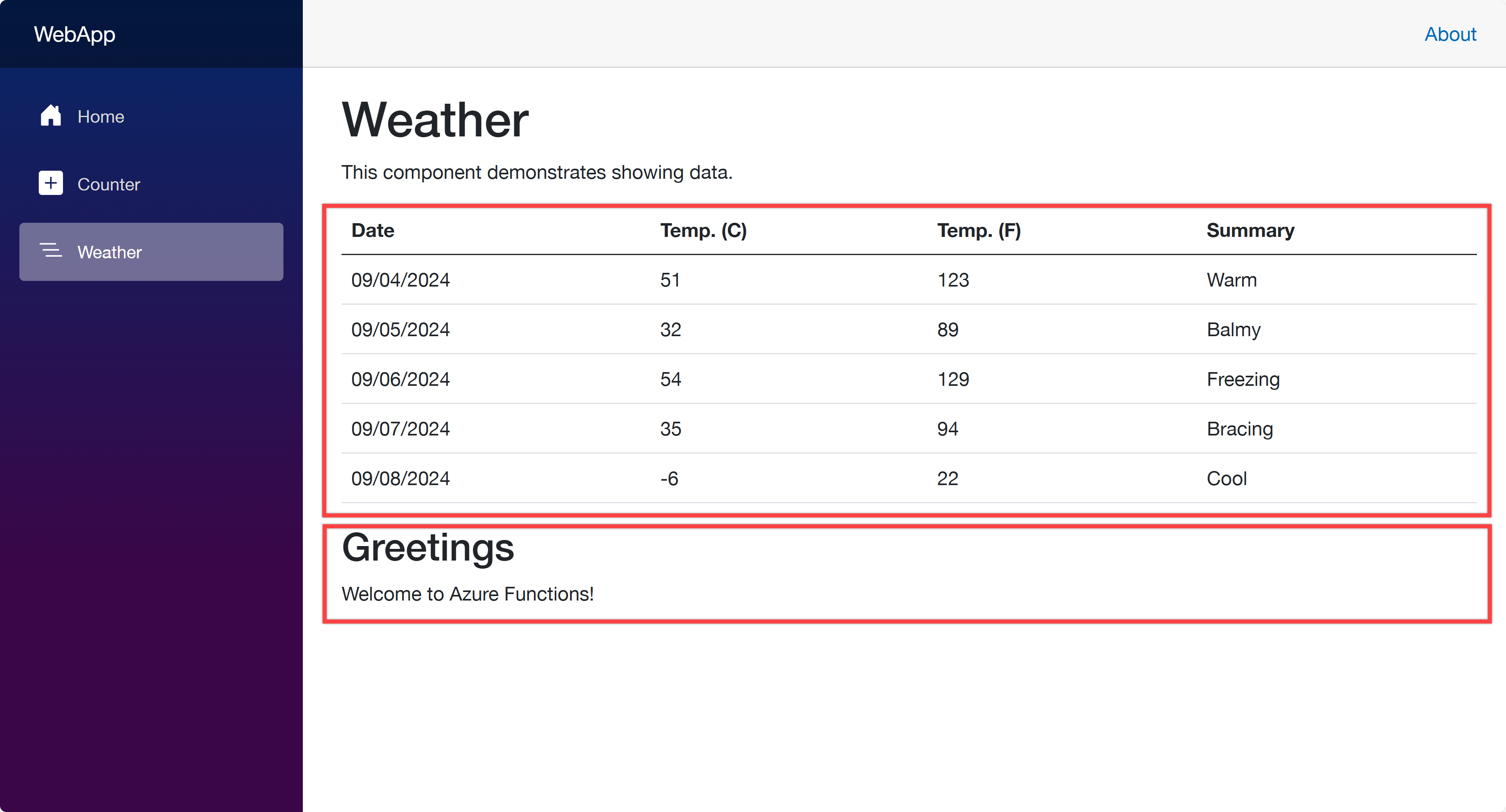

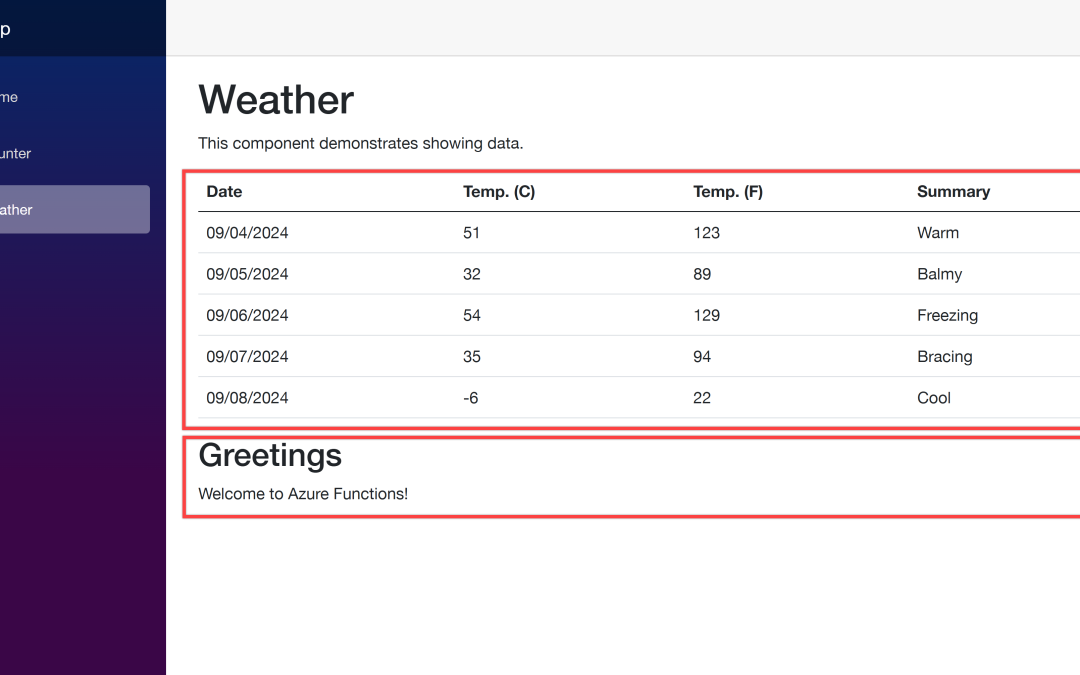

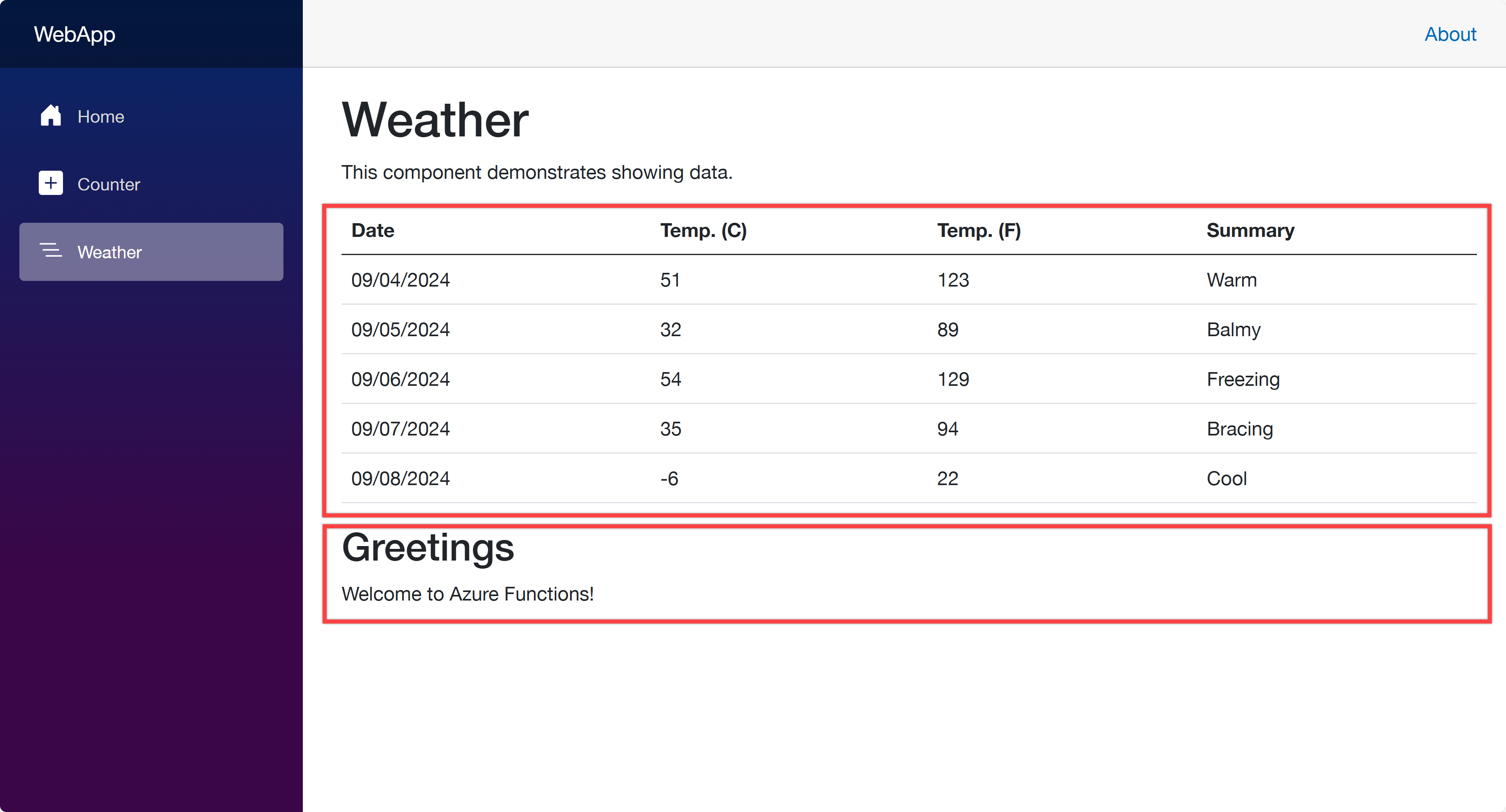

Open your web browser and navigate to https://localhost:5001 to see the Blazor app running. Then navigate to https://localhost:5001/weather to see the weather data fetched from the ApiApp and the greetings populated from the FuncApp.

Now, let’s start using azd to provision and deploy these apps to ACA. Make sure that you’ve already logged in to Azure with the azd auth login command.

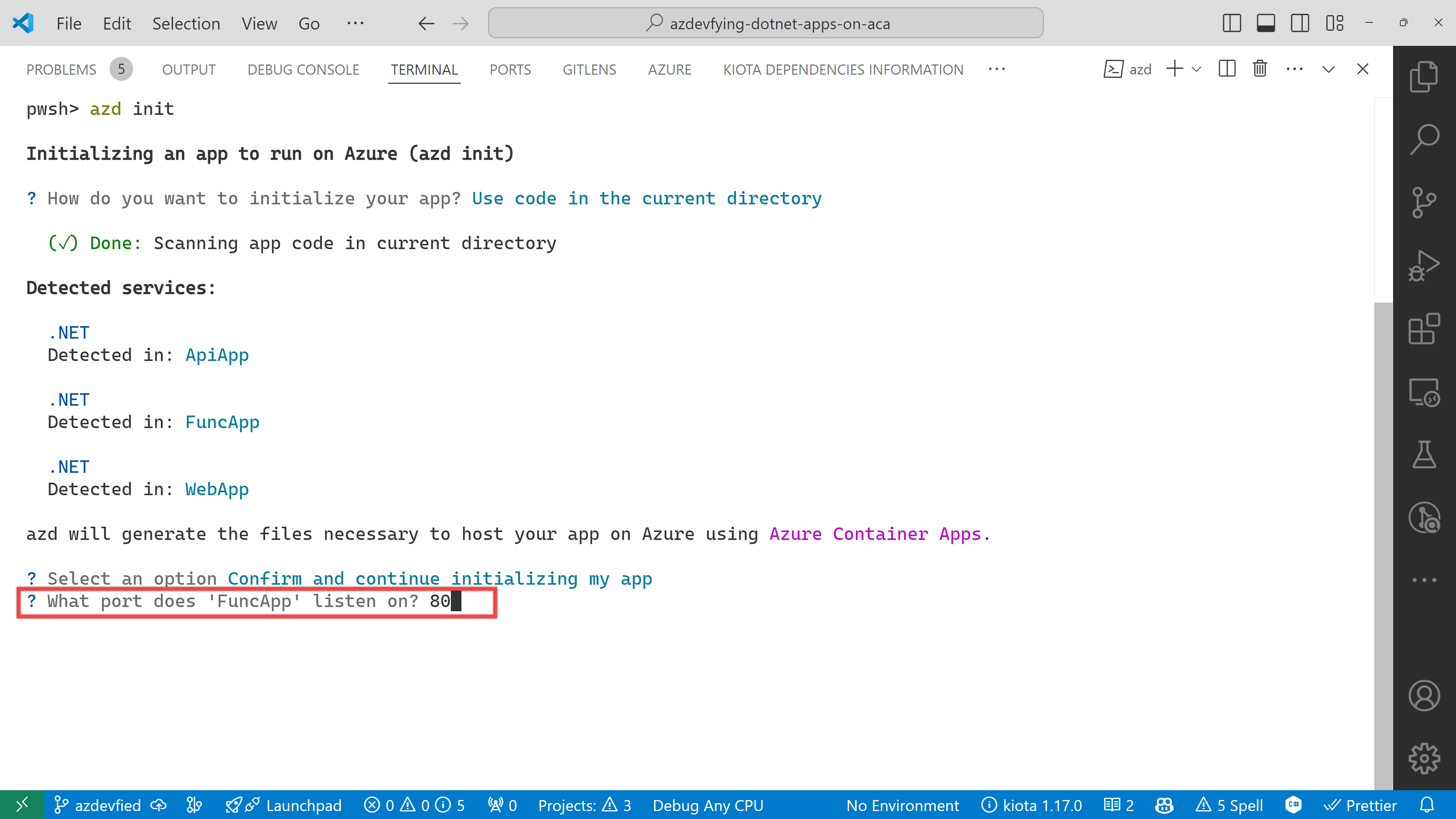

azd init – Initialisation

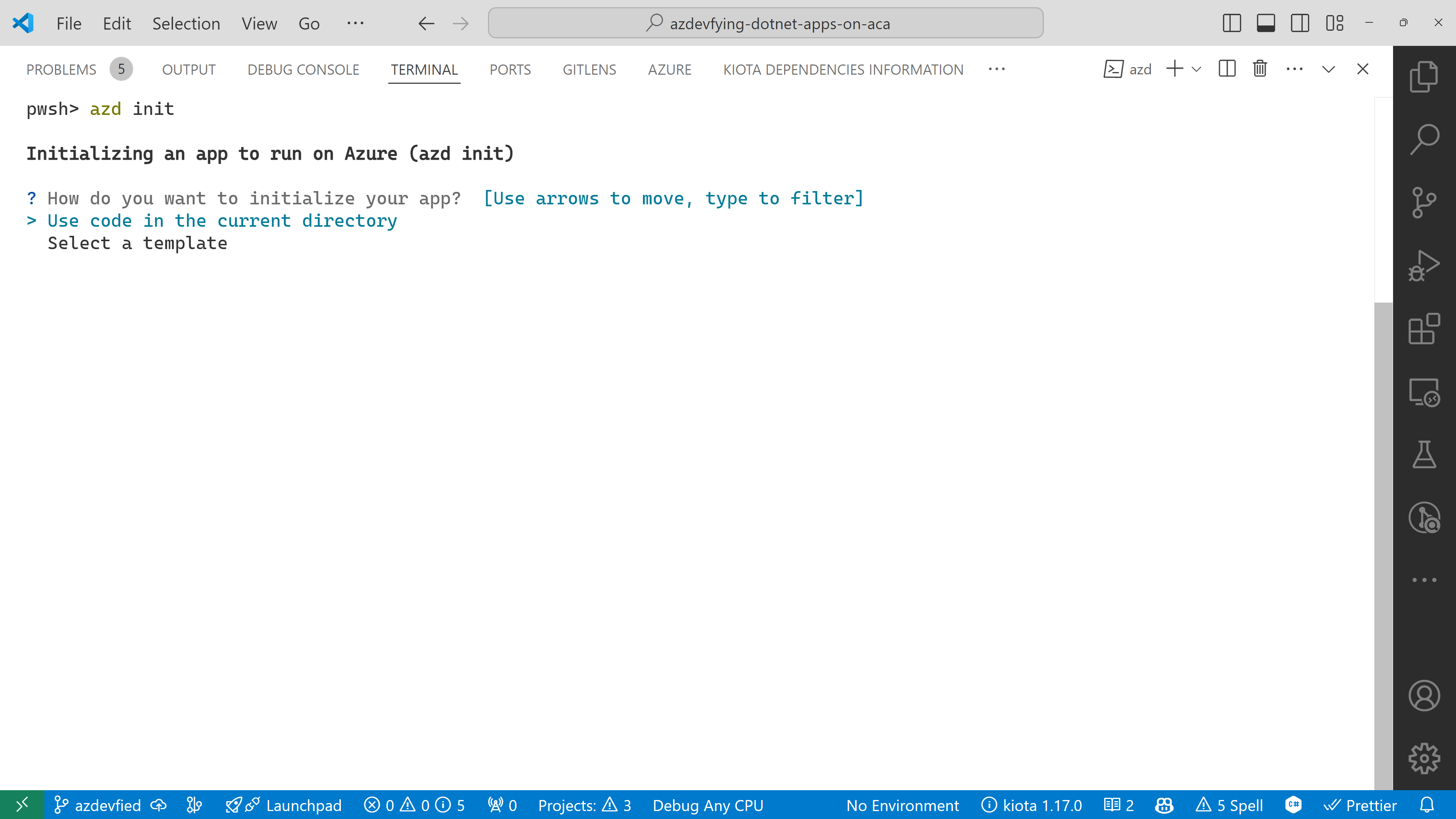

In order to provision and deploy the apps to ACA, you need to initialise the azd configuration. Run the following command:

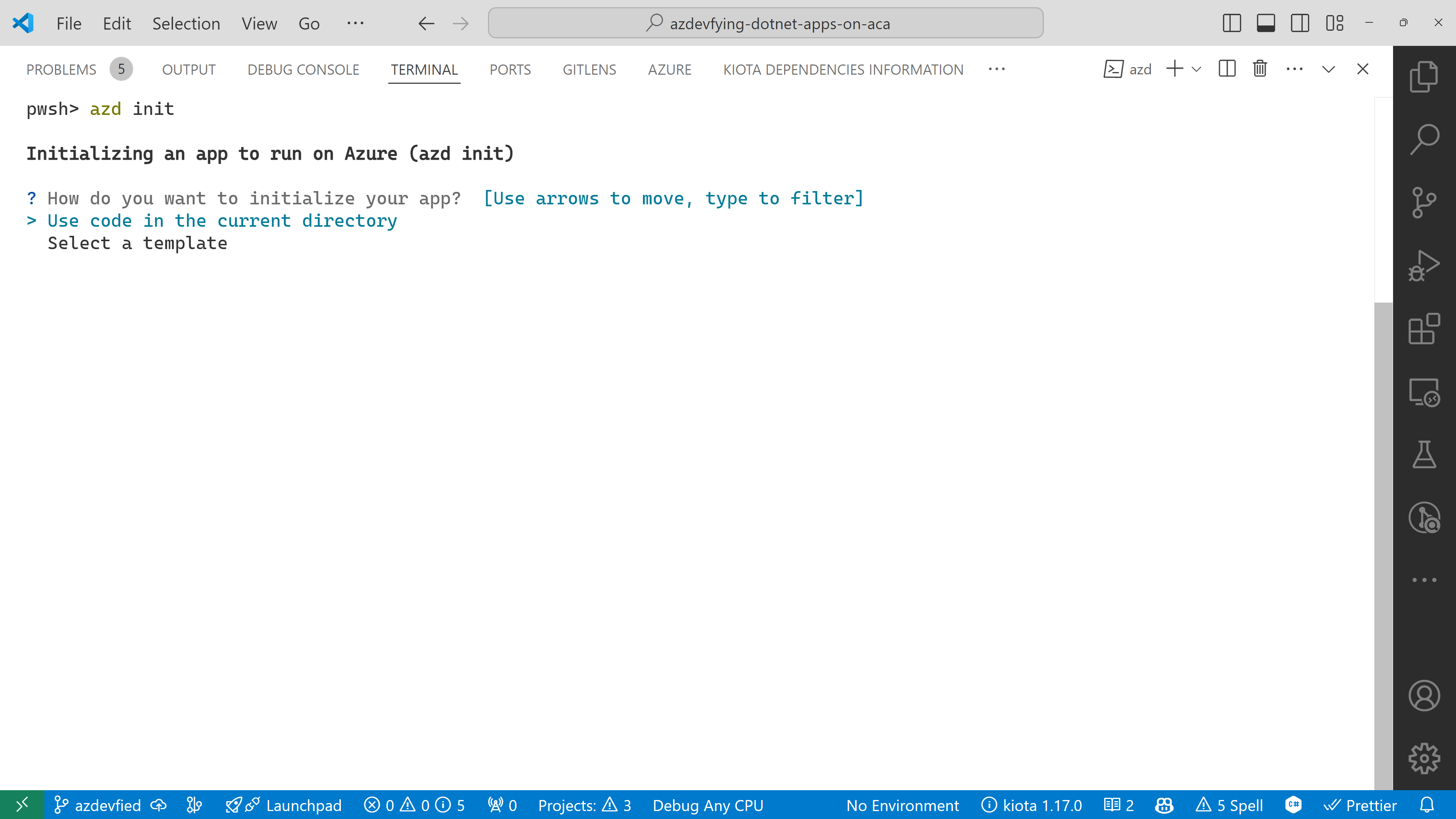

azd init

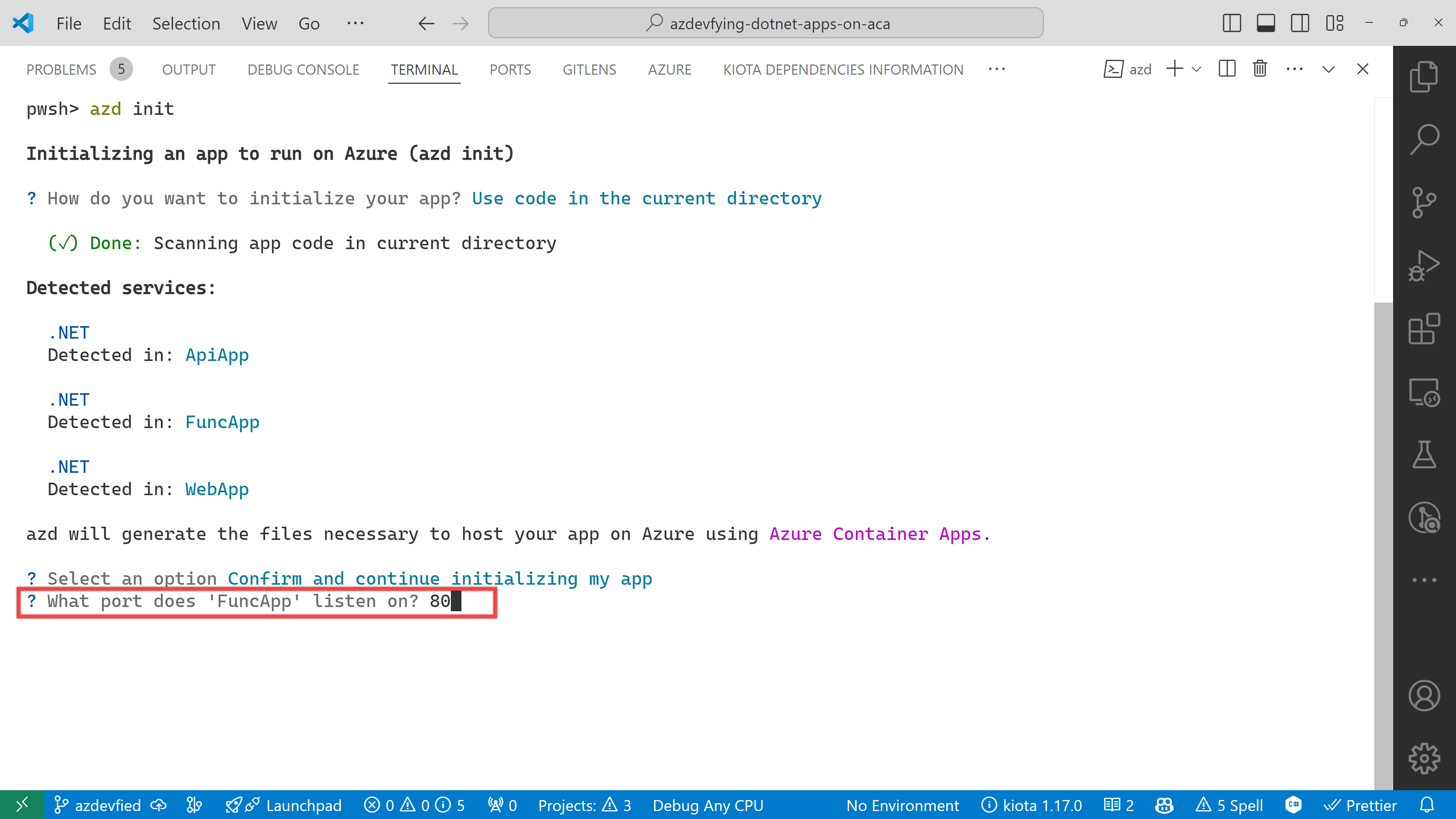

You’ll be prompted to initialise the app. Choose the Use code in the current directory option.

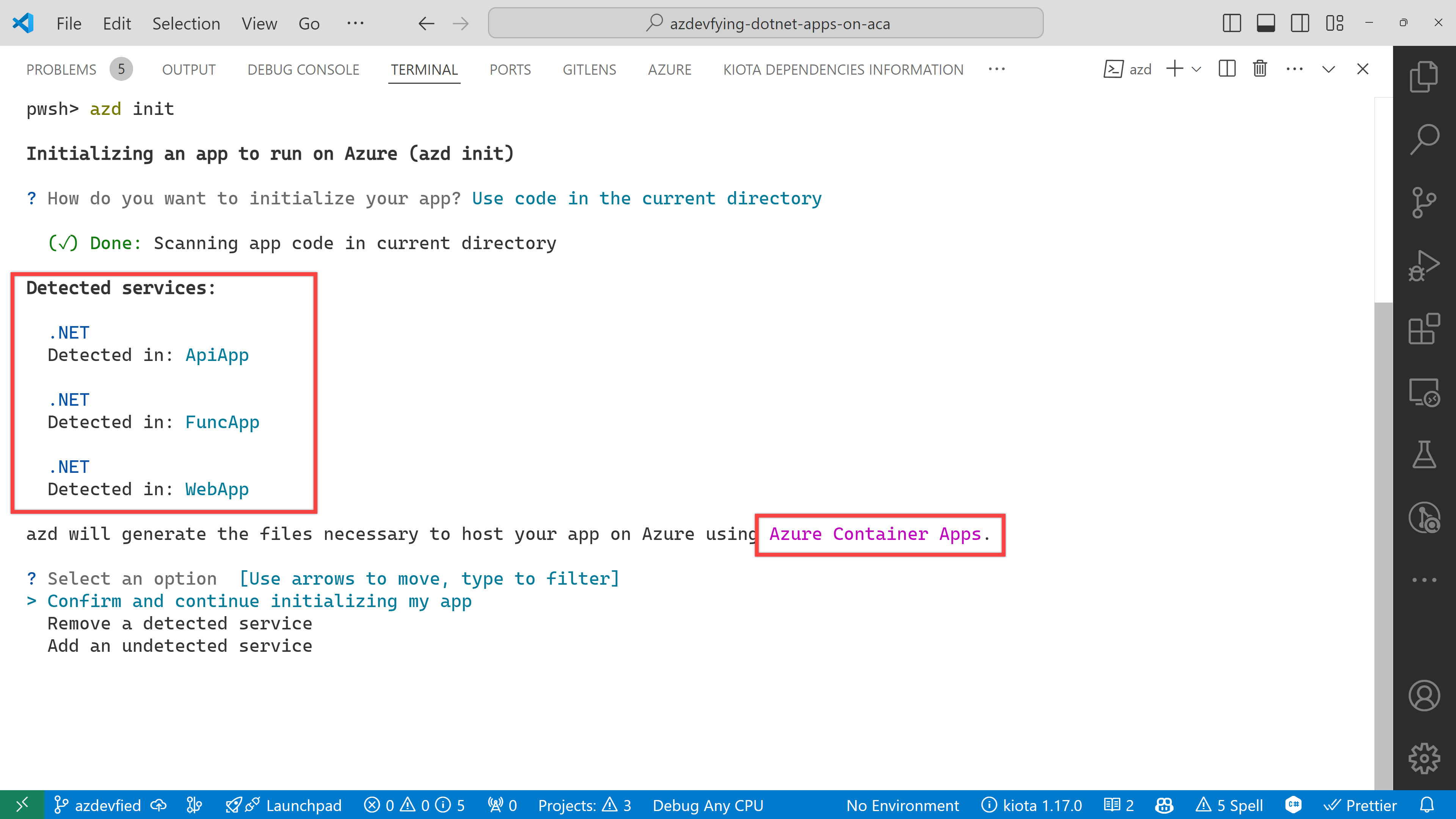

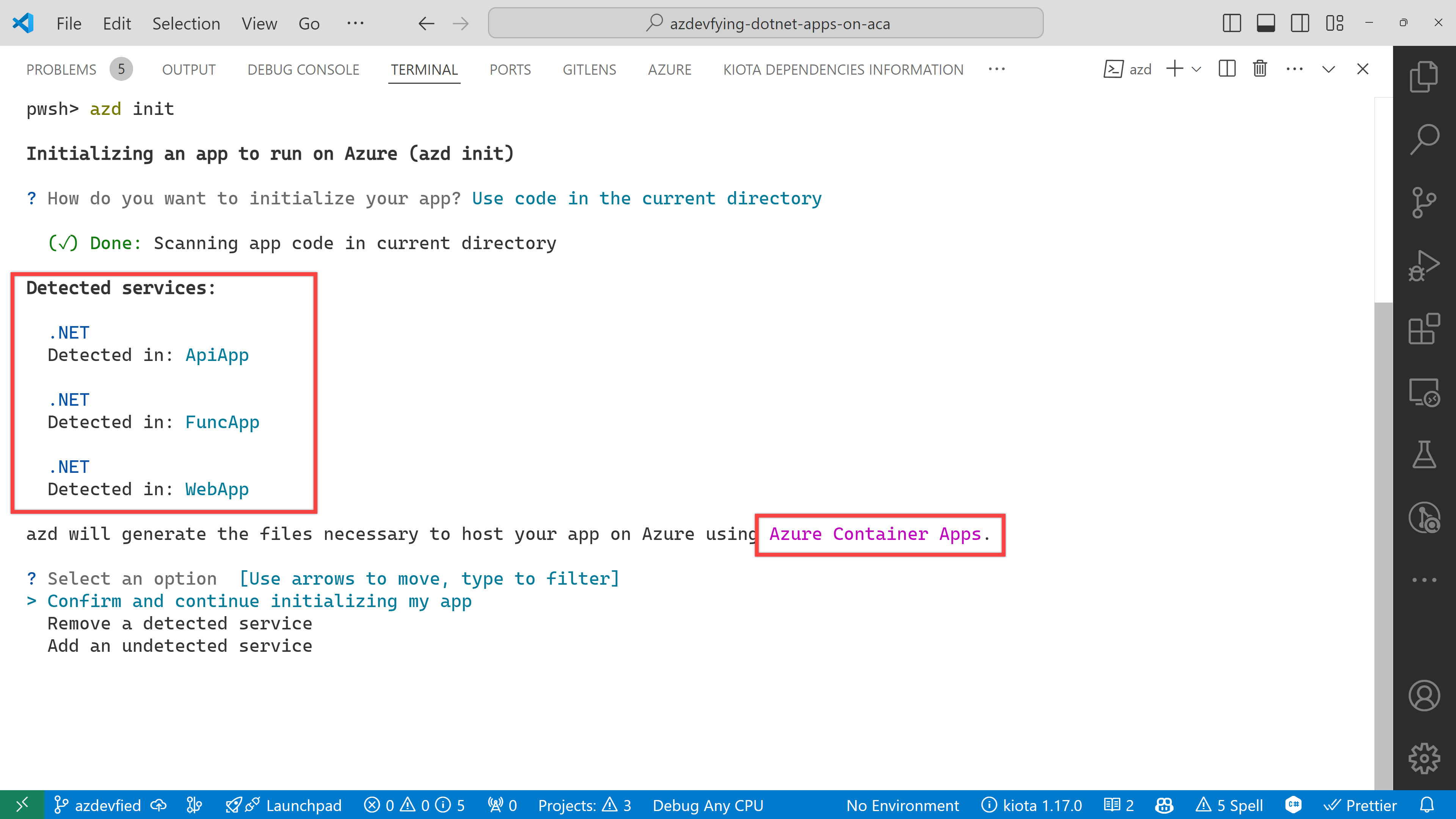

azd automatically detects your three apps as shown below. In addition to that, it says it will use Azure Container Apps. Choose the Confirm and continue initializing my app option.

The function app asks the target port number. Enter 80.

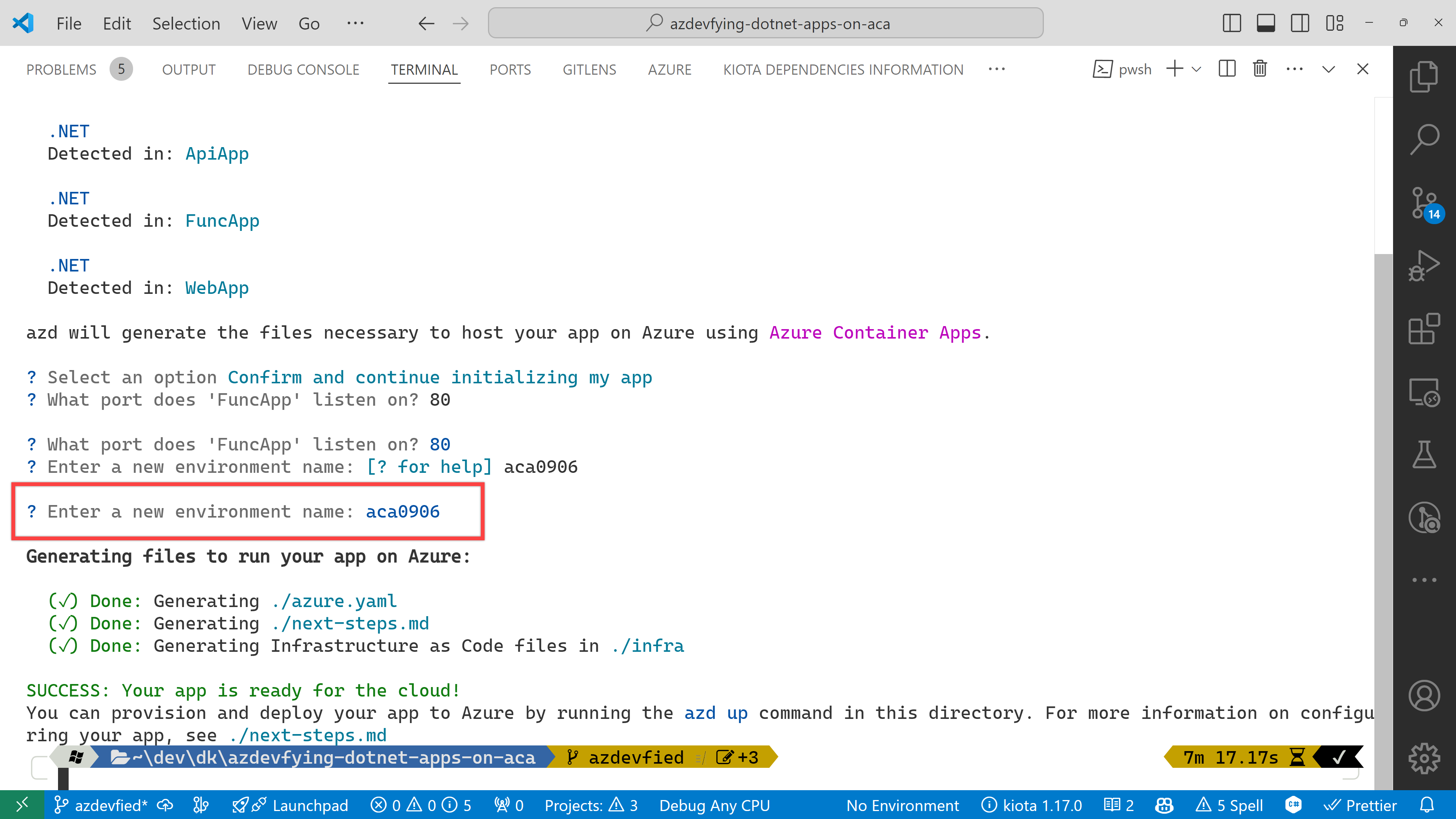

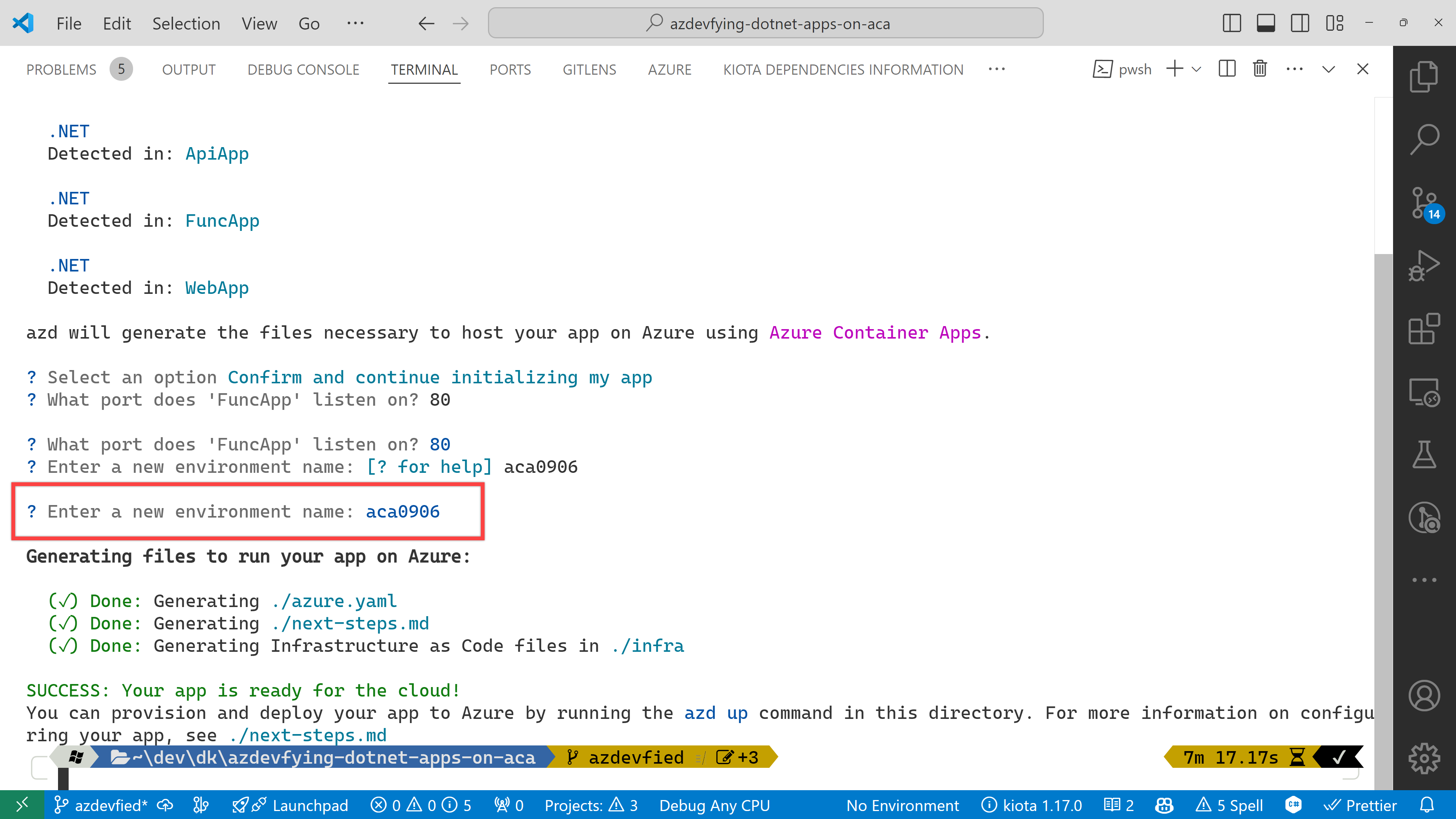

And finally, it asks the environment name. Enter any name you want. I just entered aca0906 for now.

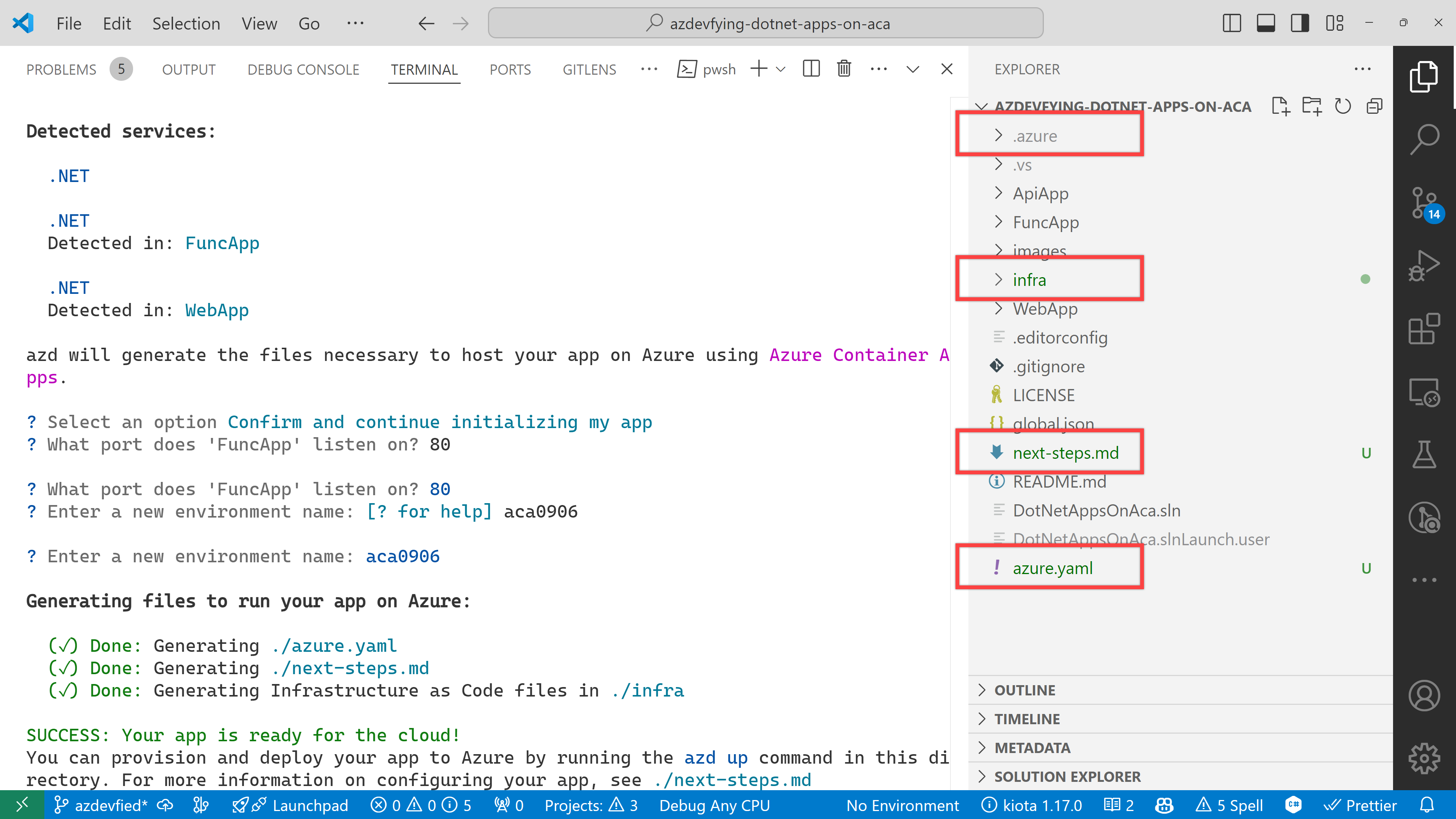

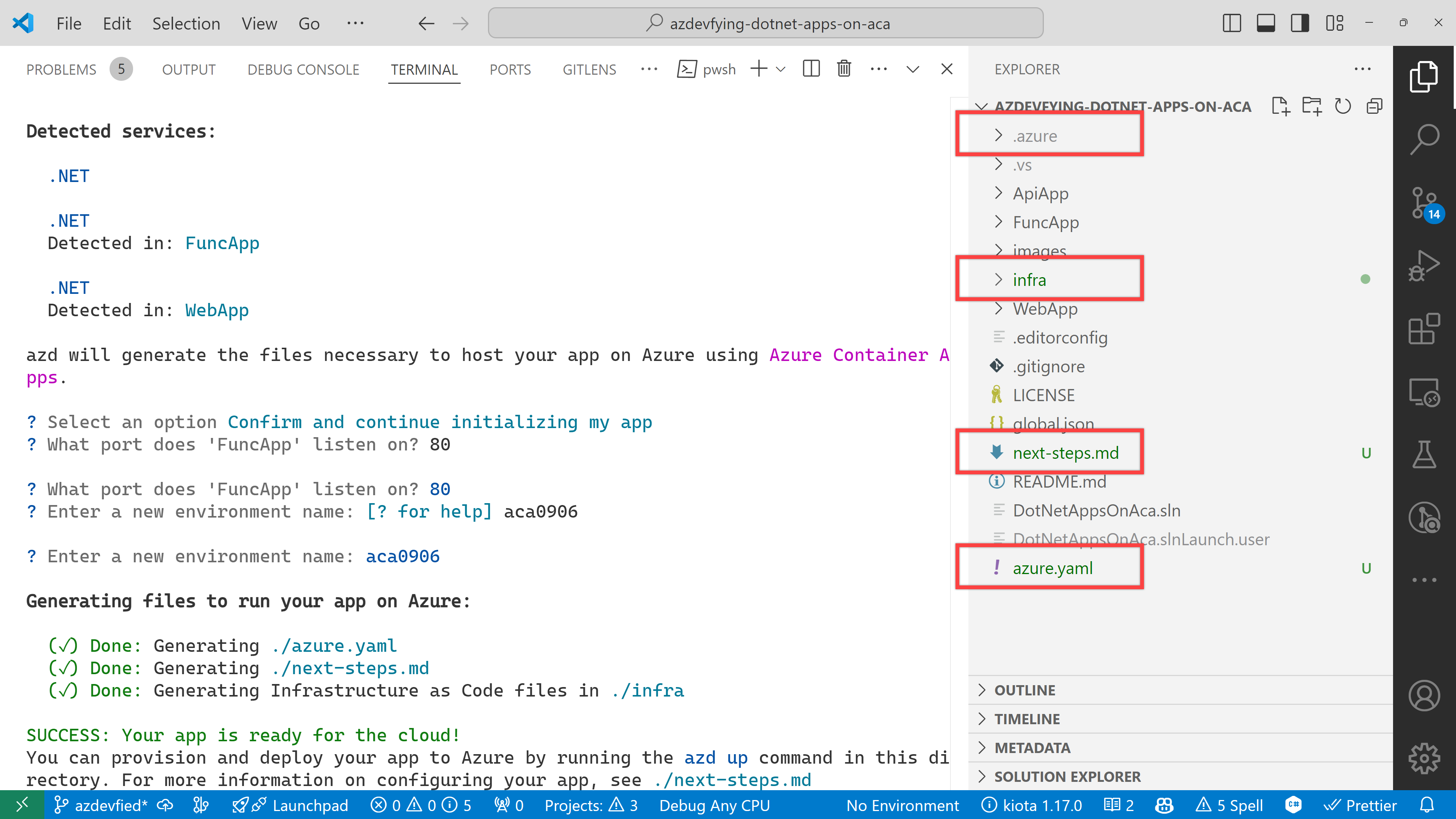

Now, you’ve got two directories and two files generated:

.azure directory

infra directory

next-steps.md file

azure.yaml file

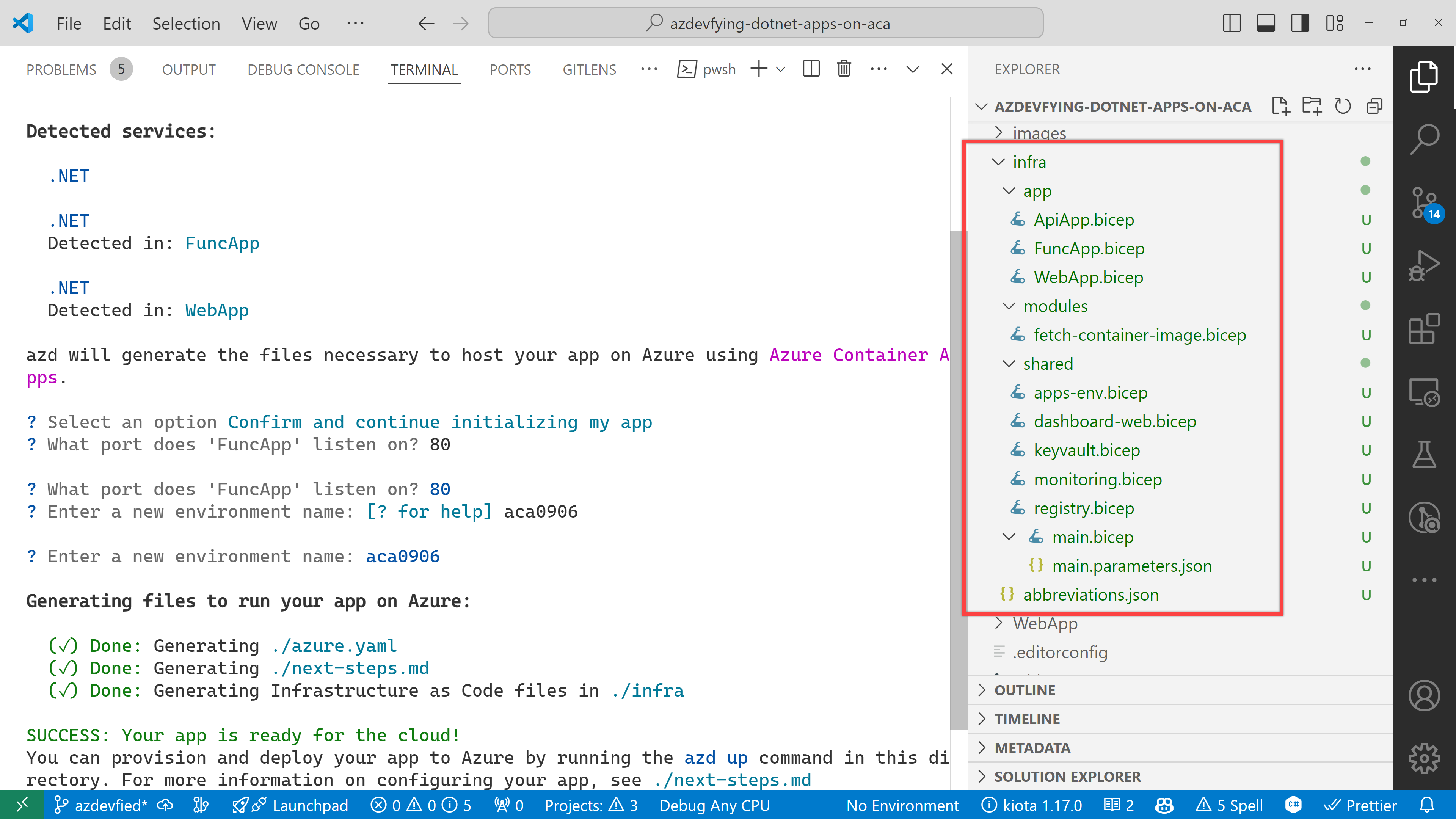

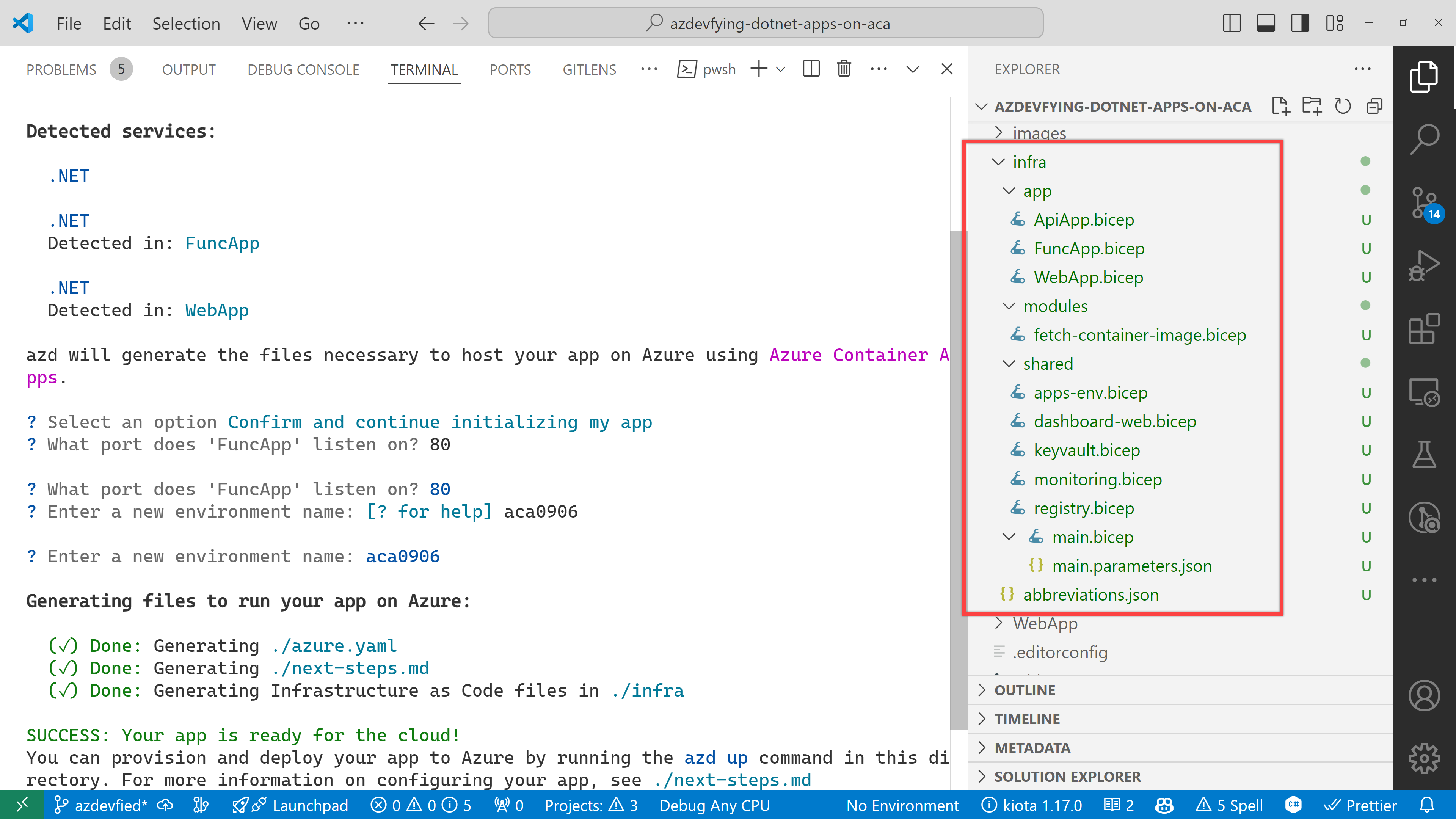

Under the infra directory, there are bunch of Bicep files automatically generated through azd init.

As a result of running the command, azd init, you don’t have to write all necessary Bicep files. Instead, it generates them for you, which significantly reduces the time for infrastructure provisioning. Now, you’re ready to provision and deploy your apps to ACA. Let’s move on.

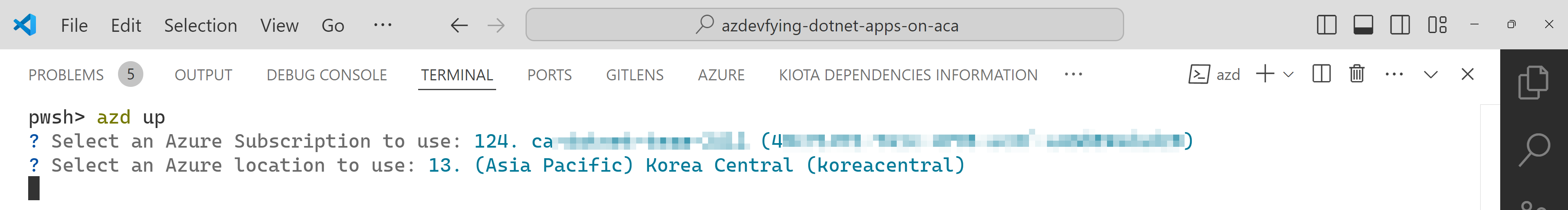

azd up – Provision and deployment

All you need to run at this stage is:

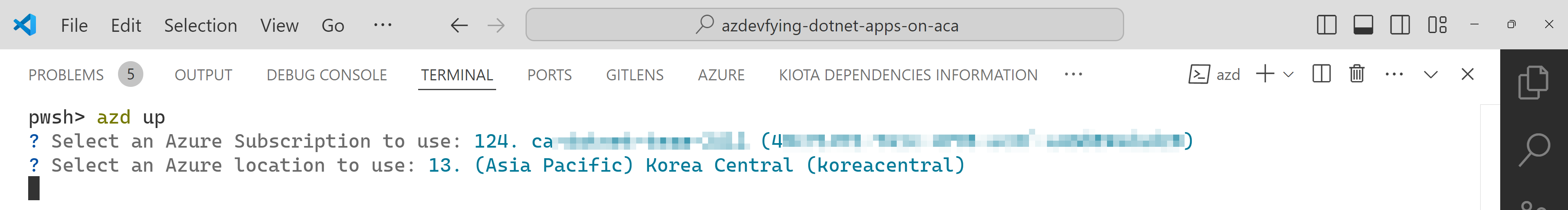

azd up

Then, it asks you to confirm the subscription and location to provision the resources. Choose the appropriate options and continue.

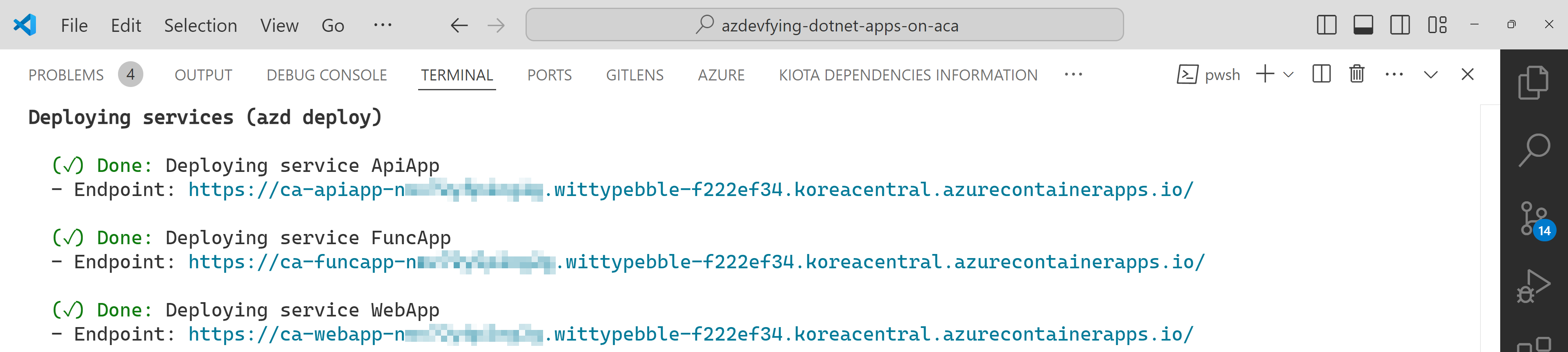

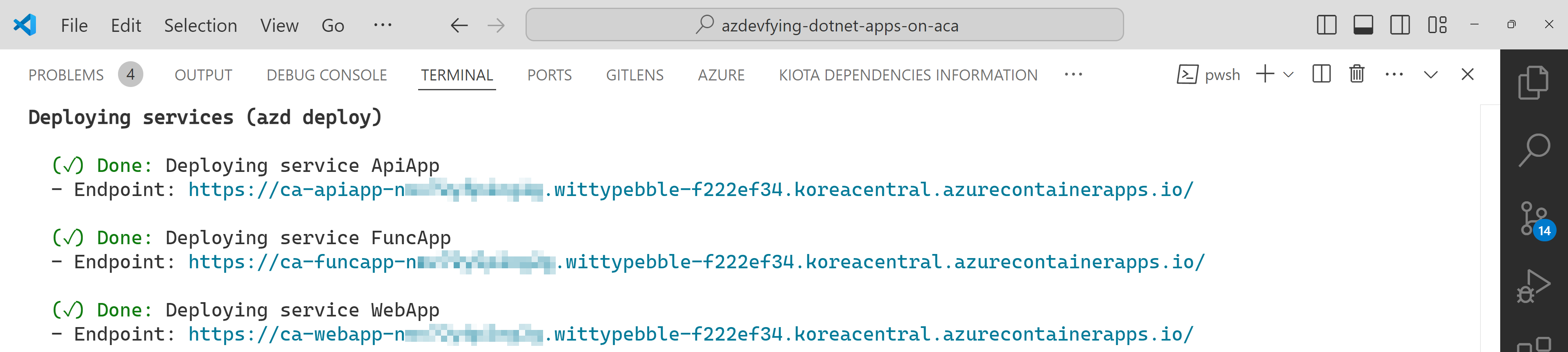

All apps are containerised and deployed to ACA. Once the deployment is done, you can see the output as shown below:

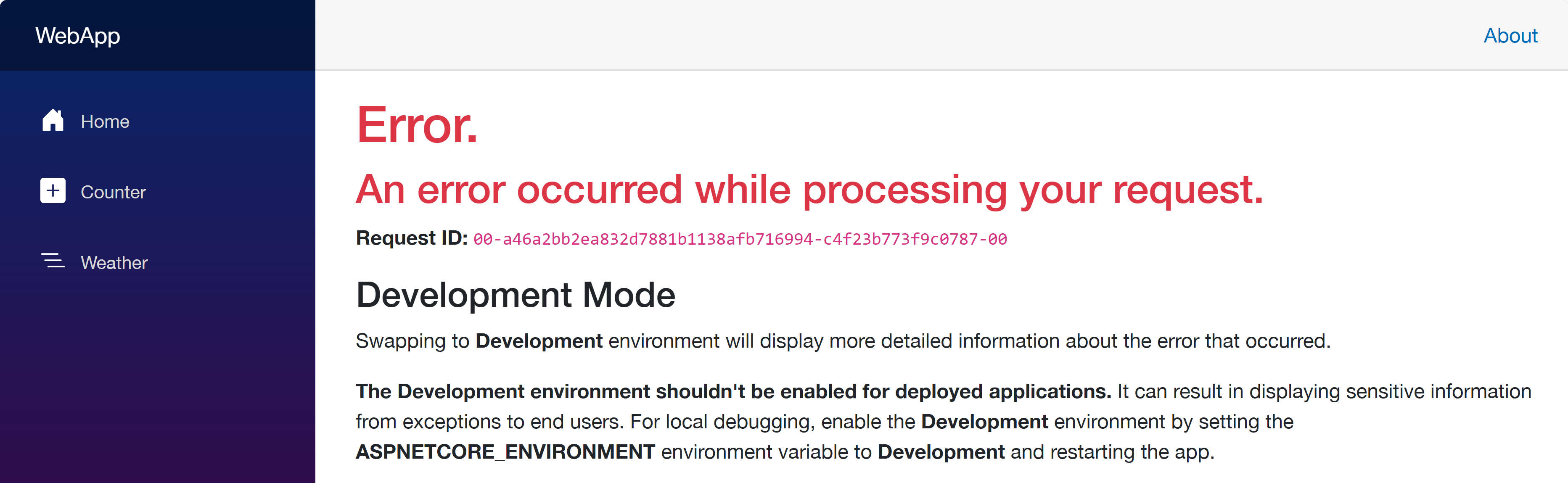

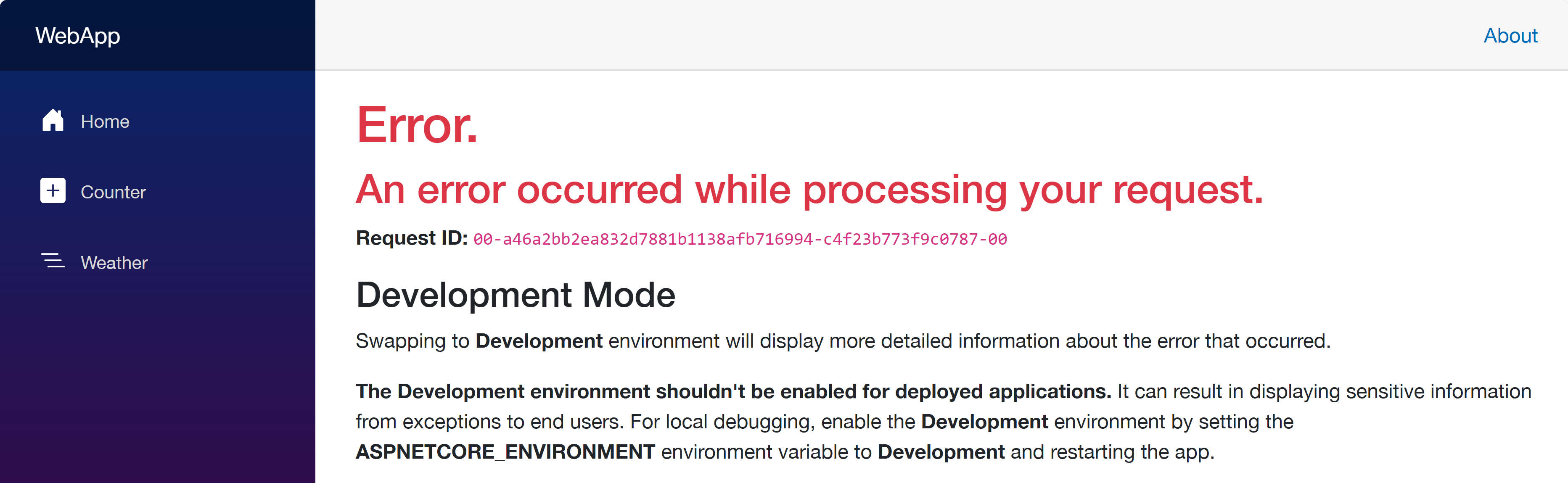

Click the web app URL and navigate to the /weather page. But you will see the error as shown below:

This is because each app doesn’t know where each other is. Therefore, you should update the Bicep files to let the web app know where the other apps are.

Update Bicep files – Service discovery

Open the infra/main.bicep file and update the webApp resource:

module webApp ‘./app/WebApp.bicep’ = {

name: ‘WebApp’

params: {

…

// Add these two lines

apiAppEndpoint: apiApp.outputs.uri

funcAppEndpoint: funcApp.outputs.uri

}

scope: rg

}

Then, open the infra/app/WebApp.bicep file and add both apiAppEndpoint and funcAppEndpoint parameters:

…

@secure()

param appDefinition object

// Add these two lines

param apiAppEndpoint string

param funcAppEndpoint string

…

In the same file, change the env variable:

// Before

var env = map(filter(appSettingsArray, i => i.?secret == null), i => {

name: i.name

value: i.value

})

// After

var env = union(map(filter(appSettingsArray, i => i.?secret == null), i => {

name: i.name

value: i.value

}), [

{

name: ‘API_ENDPOINT_URL’

value: apiAppEndpoint

}

{

name: ‘FUNC_ENDPOINT_URL’

value: funcAppEndpoint

}

])

This change passes the API and Function app endpoints to the web app as environment variables, so that the web app knows where the other apps are.

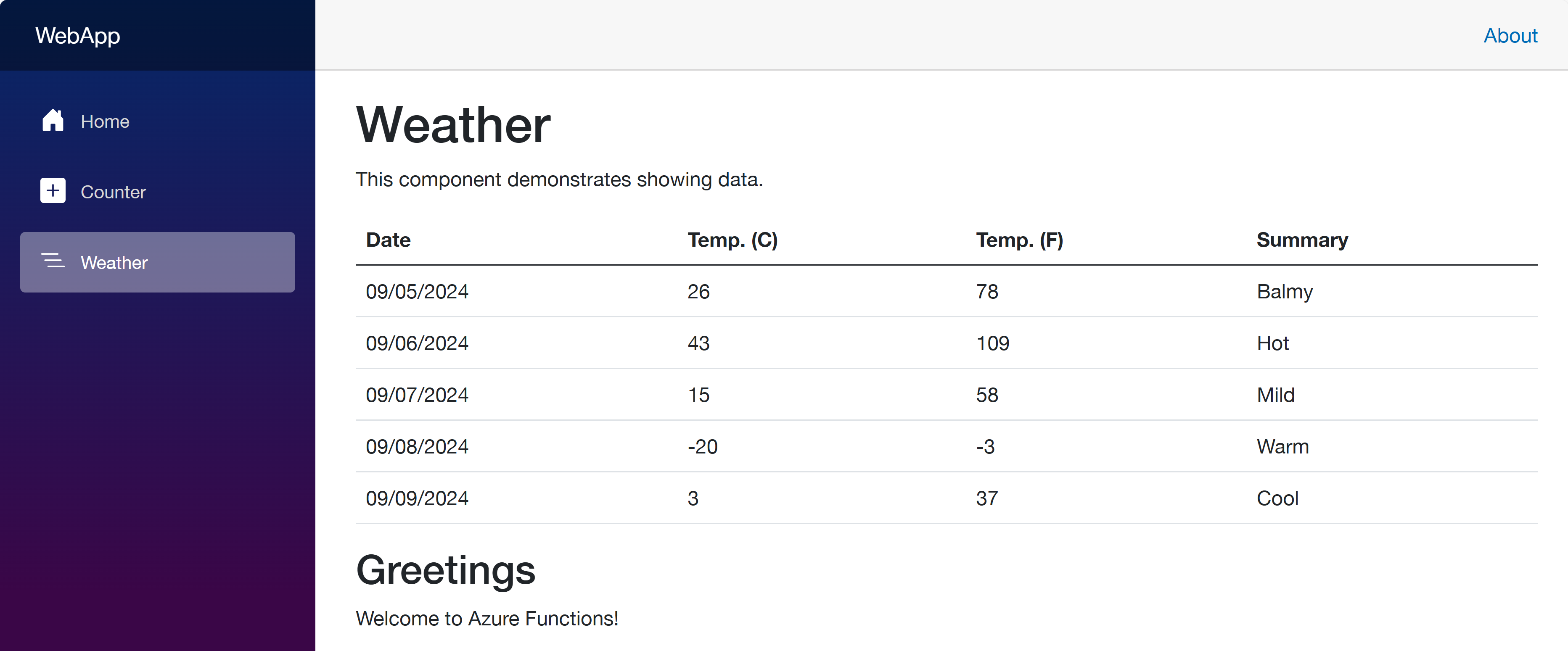

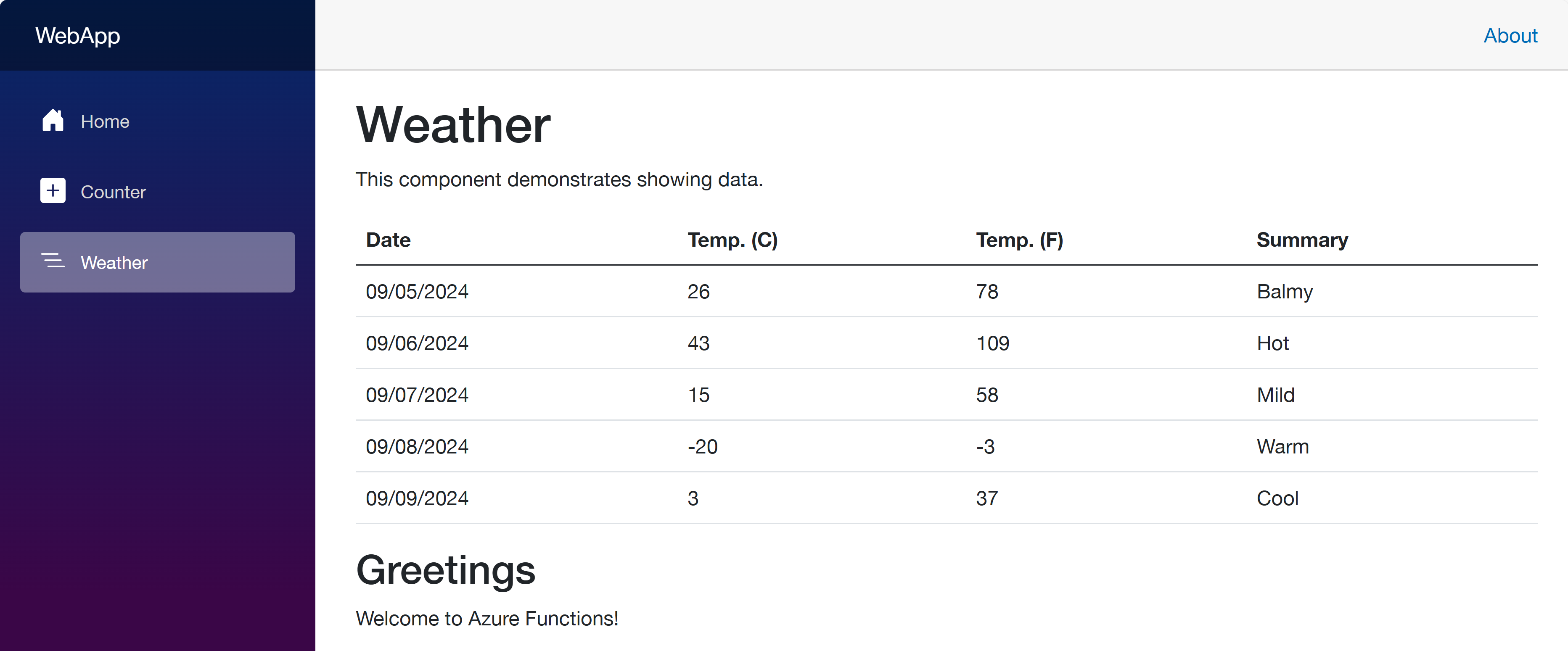

Once you’ve made the changes, run the azd up command again. It will update the resources in ACA. After that, go to the web app URL and navigate to the /weather page. You will see the weather data and greetings fetched from the API and Function apps.

So far, I’ve discussed how to provision and deploy .NET apps including Azure Functions to ACA with just one command, azd up. This is a very convenient way to deploy apps to Azure. However, to let the apps know each other, you should slightly tweak the auto-generated Bicep files. With this little tweak, all your .NET apps will be seamlessly provisioned and deployed to ACA.

One more thing I’d like to mention here, though, is that, if you use .NET Aspire, this sort of service discovery is automatically handled.

More about deploying .NET apps to ACA?

If you want to learn more options about deploying .NET apps to ACA, the following links might be helpful.

This article was originally published on Dev Kimchi.

Flow chart illustrating the logic of strong name-based mapping configuration. The chart starts with a decision diamond asking if the certificate’s Issuer Certificate Thumbprint matches the specified thumbprint. If yes, it proceeds to check if the certificate has any of the specified OIDs. If both conditions are met, it allows a strong mapping for the certificate based on either Issuer/SubjectName AltSecID or UPNSuffix, depending on the configuration.

Recent Comments